Half of APAC banks hit KYC backlog as manual systems fail

In Singapore, nine institutions were fined a combined $21m for anti-money laundering failures.

Financial institutions in Asia-Pacific (APAC) are facing growing pressure to strengthen know-your-customer (KYC) processes as regulators step up enforcement against money laundering and financial crime.

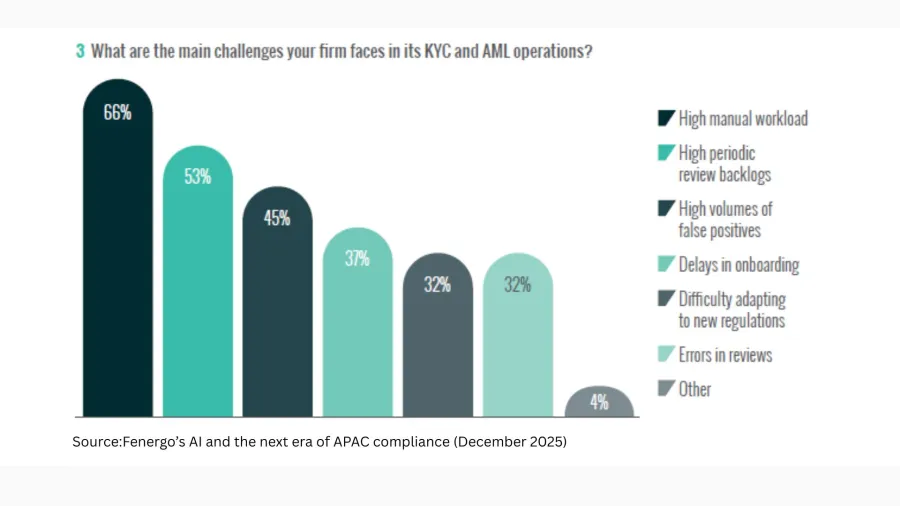

A survey by Risk.net and compliance technology firm Fenergo found that 66% of banks and asset managers still use manual workflows for KYC, whilst 53% reported a high backlog of periodic customer reviews.

The survey also highlighted accuracy issues in current screening systems.

About 45% of respondents said false positives remain a major problem, where individuals or companies are incorrectly flagged as high risk.

This is a particular challenge in markets such as Vietnam and South Korea, where similar names can make accurate identification difficult.

The survey covered 110 compliance practitioners at banks and asset managers in Singapore, Malaysia and Australia, and examined how artificial intelligence could help address operational bottlenecks in APAC compliance functions.

KYC involves collecting, verifying and reviewing large volumes of data, including identity documents and sanctions lists.

Regulators have raised expectations in recent years, warning banks and asset managers to improve their ability to detect illicit activity. Penalties for failing to meet these standards have also increased.

Whilst the largest fines have been imposed in the US and parts of Europe, APAC institutions have also faced enforcement action.

In July 2025, the Monetary Authority of Singapore fined nine institutions a combined $21m for weaknesses in controls against money laundering and terrorism financing.

Regulatory scrutiny has been heightened by the growth of crypto platforms and digital assets, which regulators see as increasing the risk of illicit capital flows.

At the same time, financial institutions across the region are rapidly digitising operations amidst rising geopolitical tensions.

Loshni Ravindranath, regional head of risk and control unit for group consumer banking at CIMB, said stricter regulatory expectations in anti-money laundering, fraud and dispute management mean compliance functions need to be more agile, more closely integrated with technology and more connected to front-line operations.

Advertise

Advertise