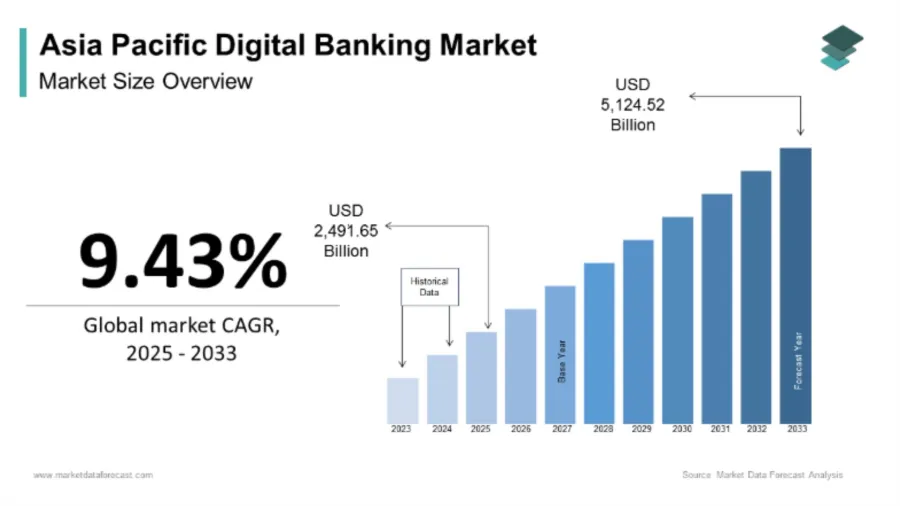

APAC digital banking market to hit $5.12t by 2033

Market Data Forecast projects a 9.43% CAGR through the next decade.

The Asia-Pacific digital banking market is expected to more than double over the next decade, growing from $2.28t in 2024 to $5.12t by 2033, according to industry estimates, according to the Market Data Forecast.

The market is projected to expand at a compound annual growth rate of 9.43%, rising to $2.49t in 2025.

Growth is being driven by wider internet and smartphone use across the region. Internet penetration reached 55% in 2022, up from 48% in 2018, with more than 2 billion active smartphone users.

Over 70% of the population now uses smartphones for online banking, supporting the uptake of mobile banking apps, digital wallets, and other online financial services.

In a previous report, digital banks branching into the mobile virtual network operator (MVNO) space still face challenges to achieving commercial viability despite reduced entry barriers, says data and analytics company GlobalData.

There is a small yet growing group of branchless digital branches who are entering the MVNO space as operators, GlobalData observed. Advancements such as e-SIM adoption and turnkey mobile virtual network enabler or MVNE/MVNO platforms have reduced barriers to entry. Banks foraying into this space is nothing new. They have long used basic prepaid mobile offers to extend customer relationships and monetize existing distribution, said Natasha Rybank, principal analyst, Global Telecom Consumer Services, GlobalData.

Countries such as South Korea and Singapore lead in connectivity, whilst Australia is using digital banking to improve access in rural areas where physical branches are limited.

Government efforts to promote financial inclusion are also supporting adoption. In the Philippines, the Bangko Sentral ng Pilipinas said more than half of adults in rural areas now use digital banking platforms, helped by initiatives such as the National Retail Payment System.

In Australia, policies that encourage open banking and links between banks and fintech firms have widened access to digital financial services.

However, cybersecurity and data privacy risks remain key challenges. The Australian Cyber Security Centre reported that cyberattacks on digital banking platforms are rising by more than 30% a year.

Only about 40% of banks in the region are said to have strong encryption systems in place, raising concerns over the protection of customer data and the resilience of digital banking operations.

Advertise

Advertise