Steady loan outlook erodes as Philippine banks brace for Q1 squeeze

Banks expecting a flat borrowing appetite fell significantly from a previous high of 80.7%.

Most Philippine banks expect business loan demand to remain steady in the first quarter of 2026 (Q1 2026), although fewer banks hold this view compared with the previous quarter, according to the Bangko Sentral ng Pilipinas’ Senior Bank Loan Officers’ Survey.

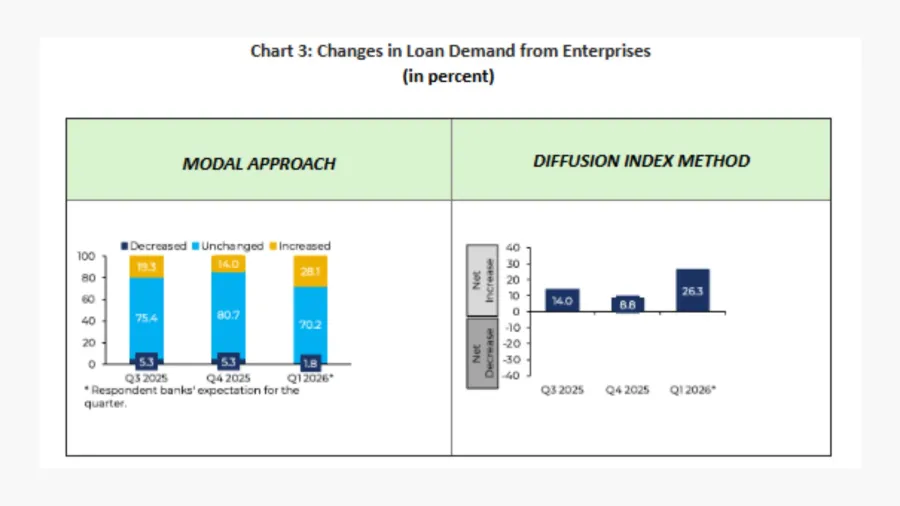

Around 70.2% of banks see business loan demand holding steady in Q1 2026, down from 80.7% in Q4 2025.

Meanwhile, 28.1% expect demand to increase, up from 14.0% in the previous quarter. Only 1.8% of banks anticipate a decline in loan demand, lower than the 5.3% recorded in Q4 2025.

Banks are generally inclined to keep their credit standards unchanged for both businesses and households in Q1 2026.

For enterprise loans, 87.7% of banks expect to maintain current credit standards, slightly higher than 86.0% in the previous quarter.

Of the remaining banks, 10.5% plan to tighten lending standards, whilst 1.8% expect to ease them.

For household loans, 79.5% of banks expect to retain existing credit standards, down from 82.5% in Q4 2025. The rest of the respondents are split between tightening standards at 12.8% and easing at 7.7%.

Amongst banks that expect to change their lending standards, more foresee tightening rather than easing.

A net 8.8% expect tighter credit standards for business loans in Q1 2026, compared with a net 14.0% in the previous quarter.

For household loans, the net tightening expectation stands at 5.1%, down from 7.5% in Q4 2025.

Advertise

Advertise