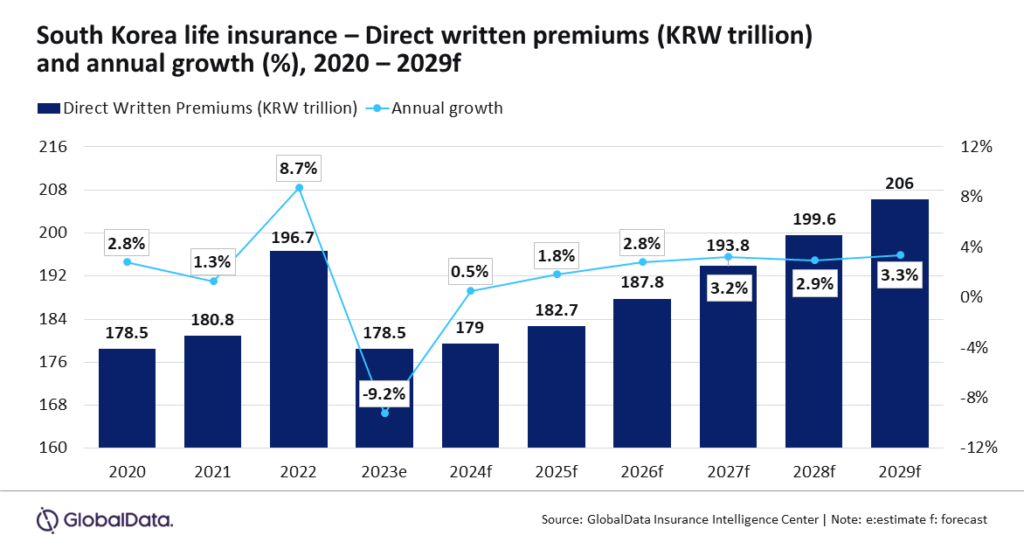

South Korea’s life insurance market to bag $158b through 2029

The industry is projected to recover in 2024 after a decline in 2023.

The life insurance sector in South Korea is seen to register a compound annual growth rate (CAGR) of 3.1% from $139.8b this year to $157.9b in 2029, in terms of direct written premiums (DWP), revealed GlobalData.

The industry is projected to recover in 2024 and 2025 after a 9.2% decline in 2023.

The rebound is attributed to economic recovery and demographic changes, particularly an aging population, which is driving demand for whole-life and pension policies.

“The South Korean economy witnessed a slower growth of 1.4% in 2023 that affected the demand for life insurance products. GlobalData expects the economy to rebound and grow by 2.2% in 2024 and 1.8% in 2025, which will support the demand for long-term and pension products,” Prasanth Katam, Insurance Analyst at GlobalData, said in a report.

Pension insurance, the largest segment, is expected to account for 39.7% of the industry’s DWP in 2024.

It grew by 4.7% this year, supported by stable market conditions and higher investment returns.

The National Pension Service reported a 9.2% return on investments, totaling $70b in the first nine months of 2024, largely due to strong foreign equity performance.

Pension insurance is expected to grow at a CAGR of 4.7% from 2025 to 2029.

Whole life insurance, the second-largest segment, is projected to hold a 12.4% share of DWP in 2024 and grow at a CAGR of 1.2% over the next five years.

South Korea’s aging population is a key factor in this growth, with those aged 65 and older expected to make up 20.3% of the population in 2025, rising to 39.4% by 2050.

Endowment insurance, with an estimated 11.1% market share in 2024, is expected to grow at a CAGR of 1.4% through 2029.

The segment benefits from demand for high-return products, particularly as declining interest rates make endowment plans a more attractive investment.

As of February 2024, the average interest rate on new deposits was 3.6%, down 4 basis points from the previous month.

Term life, general annuity, and other life insurance products are projected to account for 36.9% of DWP in 2024.

“The South Korean life insurance industry is poised for steady growth, driven by economic recovery and changing demographics that are contributing to the demand for long-term care and pension solutions,” Katam said.

“The changing market dynamics will prompt insurers to offer policies for the aging population, which are likely to contribute to the industry’s growth over the next five years,” added Katam.

Advertise

Advertise