APAC insurers wary of geopolitical instability in next two years

Cyber threats, on the other hand, are a moderate to severe risk.

Artificial intelligence (AI) has emerged as the top risk for the insurance sector in 2025, overtaking concerns such as cyber threats and extreme weather, according to Kennedys’ latest Global Forecast Report.

In the Asia-Pacific region, about 80% of Kennedys partners in Singapore, Hong Kong, Australia, and New Zealand rate cyber threats as a moderate to severe risk for the sector.

Geopolitical instability is another growing concern, with 44% of respondents predicting it will have the most significant impact on the insurance industry within the next one to two years.

Global concerns

Sustainability issues, previously a major focus, have fallen to the lowest ranking amongst identified risks globally.

The report, based on a survey of 170 Kennedys partners conducted between November and December 2024, highlights key challenges facing the industry globally. AI adoption now leads the risk index, followed by cyberattacks and outages, and extreme weather events.

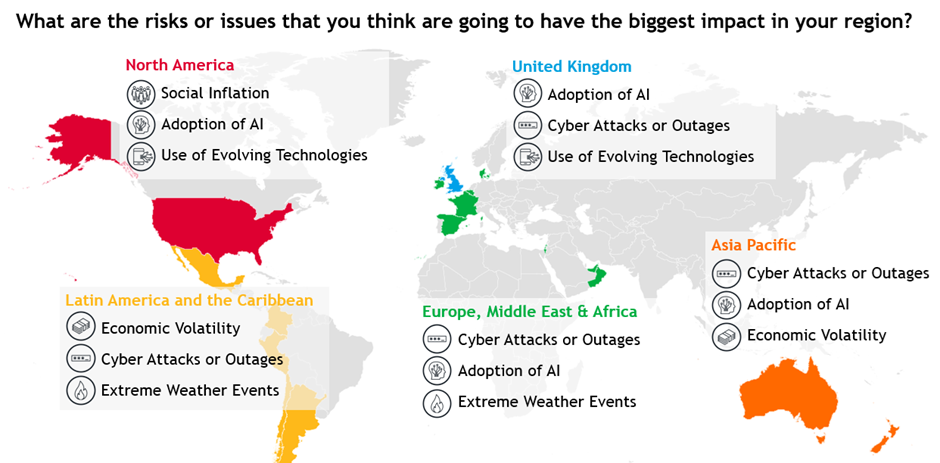

Risk priorities vary by region. Geopolitical instability is a top concern in Asia-Pacific and Latin America due to ongoing political uncertainties and conflicts.

Despite ranking as the top risk, AI’s full impact is expected to materialise over the next three to five years, according to 85% of respondents.

By contrast, social inflation and cyber risks are seen as more immediate threats.

The financial impact of AI on insurance remains unclear. The industry faces potential coverage gaps if traditional policies fail to account for AI-related losses, similar to past “silent cyber” issues where cyber risks were unintentionally covered under non-cyber policies.

Experts warn that insurers must proactively assess AI risk exposure to prevent future coverage disputes.

Advertise

Advertise