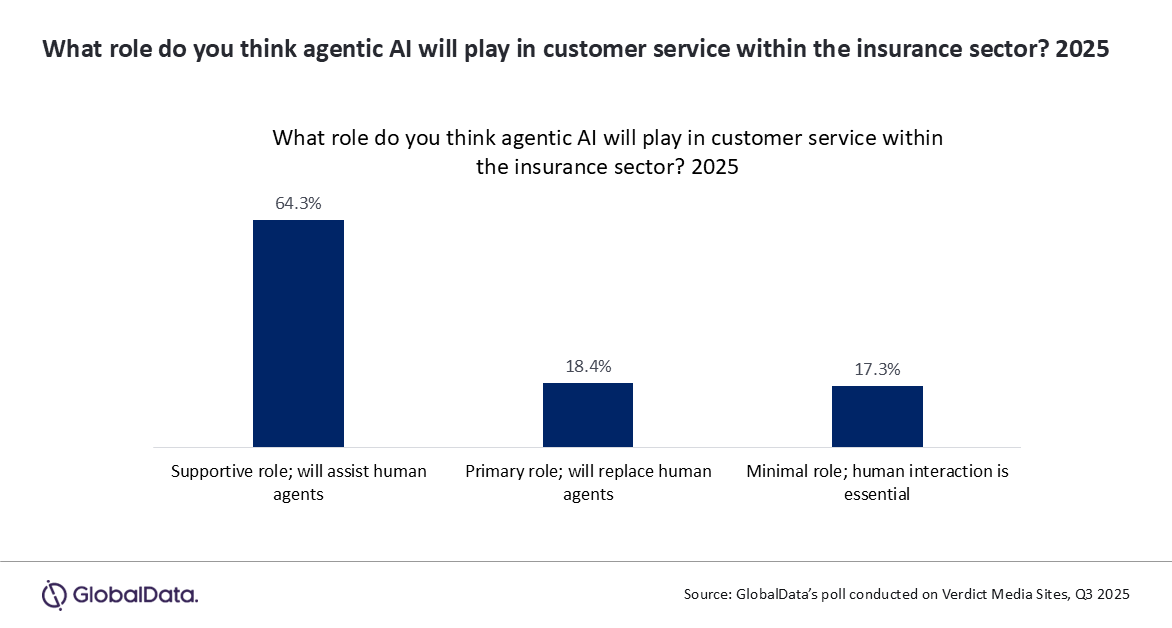

Why 1 in 5 think AI will replace human insurance agents

Over half were comfortable using AI with a human option available.

Nearly two-thirds of individuals believe that agentic artificial intelligence (AI) will play a supportive role in the insurance industry, with humans still in the background, whilst only 18.4% think it will replace human agents.

Ben Carey-Evans, Senior Insurance analyst at GlobalData, said AI is already improving customer service through instant responses and round-the-clock availability.

However, he noted that human oversight remains important to maintain trust and accuracy in service delivery.

Findings from GlobalData’s Emerging Trends in Insurance Survey also showed that consumers prefer having access to a human agent when using AI.

About 56.5% said they were comfortable using AI with a human option available, compared with 42.5% who were comfortable interacting with AI alone.

Amongst those not comfortable using AI to obtain insurance quotes, 42.9% said they would be more willing to do so if a human agent could step in when needed.

Carey-Evans said these results highlight that both consumers and insurers see the value of combining AI and human input.

“Critically, agentic AI can make decisions in real time and is not just giving responses based on a set of pre-loaded instructions. This means it has a better capability of answering customer issues in a live chat situation. This can therefore create a very-powerful customer service tool for insurers,” Carey-Evans said.

Advertise

Advertise