Why are floods driving Thailand property insurance growth?

Gross written premiums are expected to rise from $1.7b in 2026 to $2b by 2030.

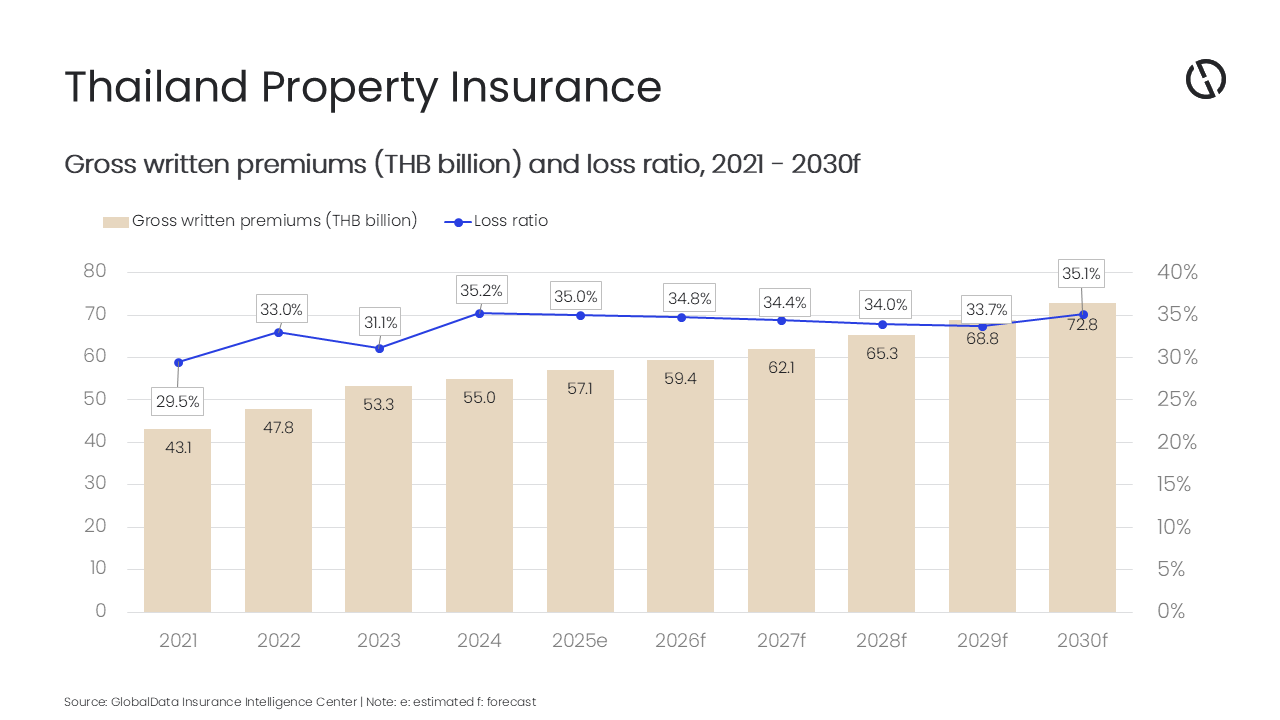

Thailand’s property insurance premiums will see steady growth in the next five years, registering a compound annual growth rate of 5.22% due to rising catastrophe risk, according to GlobalData.

Severe flooding in southern Thailand over recent weeks has caused widespread damage, with economic losses estimated at more than $14b, according to the Ministry of Finance.

Gross written premiums are expected to rise from $1.7b in 2026 to $2b by 2030.

GlobalData said rising disaster risks, including floods and earthquakes, are increasing insurance and reinsurance costs and excess-of-loss premiums, putting pressure on profitability.

Despite this, the property insurance market is expected to remain resilient, with the average loss ratio projected to stay below 35% during the 2026 to 2030 period.

The recent floods have followed a magnitude-7.7 earthquake on 28 March 2025, centred in Sagaing, Myanmar, with tremors felt in Bangkok.

These events have highlighted weaknesses in catastrophe risk modelling in Thailand. Insured losses from the floods could reach up to $1.4b, according to the Thailand General Insurance Association.

The collapse of a major construction project, the Chatuchak skyscraper, has also raised concerns about structural resilience, regulatory compliance, and policy coverage limits.

In Songkhla province, insurers received more than 500 property damage claims within days of the mid-November 2025 flooding, according to the Office of the Insurance Commission (OIC).

Industry officials expect claims across the affected southern region to rise into the thousands as assessments continue.

The floods have also exposed a widening protection gap, with many property policies lacking flood cover or subject to sub-limits and exclusions.

The OIC’s Insurance Development Plan for 2026 to 2030 focuses on improving risk management and underwriting standards for natural hazards, promoting digital claims processing, and reducing coverage gaps.

GlobalData said higher-than-expected claims from natural disasters are likely to push actual property losses above earlier projections.

In response, insurers are expanding multi-hazard property and condominium coverage, offering more flexible products for households and small and medium enterprises, and increasing the use of digital tools such as AI and data analytics to improve underwriting and claims efficiency.

Advertise

Advertise