PayMaya Philippines launches microinsurance service PayMaya Protect

The digital payments platform has teamed up with bolttech for this latest project.

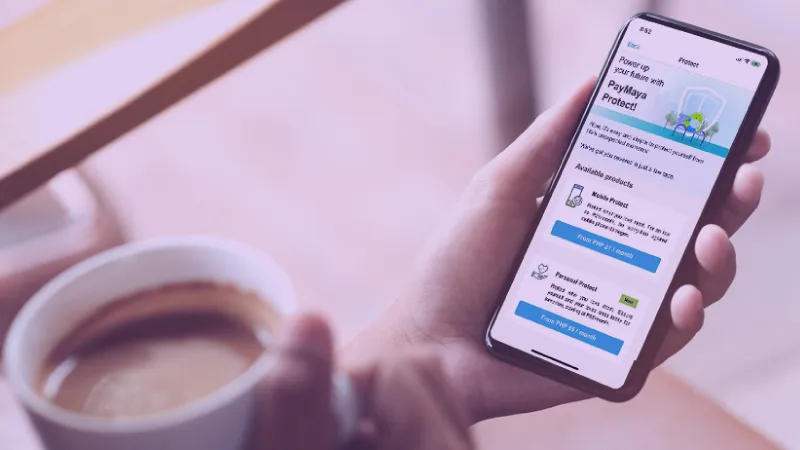

PayMaya Philippines, in close partnership with international insurtech firm bolttech, has launched PayMaya Protect, to give Filipinos easier access to affordable microinsurance and services products on the PayMaya app.

Through the collaboration, PayMaya's customers can benefit from relevant and easy-to-understand coverage in the PayMaya app's Protect feature, powered by bolttech's cutting-edge insurance exchange platform.

Amongst the first products launched on the app will be Personal Protect which covers dengue, COVID-19 and Permanent Total Disability, offered through a partnership between PayMaya, bolttech, and the underwriter Pioneer Insurance & Surety Corporation. Mobile Protect will also be available at launch, providing extensive mobile device services for cracked screens, water damage, and other incidents. The purchase experience offers an end-to-end checkout with an AI-driven diagnostic feature providing instant protection through the app, a first in the market.

PayMaya Protect promises to deliver more flexibility to customers, giving them more choices and better control over their finances. The products allow a subscription model so that customers can choose when they need cover.

"Our goal is to bring more insurance and other protection products closer to the hands of every Filipino. Our deep understanding of our customers combined with bolttech's leading-edge expertise will enable us to achieve this through our top-rated and reliable PayMaya app,” Shailesh Baidwan, President of PayMaya.

The launch of PayMaya Protect is part of PayMaya's broader digital financial services thrust, which includes the establishment of Maya Bank, the most recent recipient of a digital banking license from the Bangko Sentral ng Pilipinas (BSP).

Advertise

Advertise