Why Taiwan’s insurance outlook remains solid through 2029

The market is projected to expand by 8.8% this year.

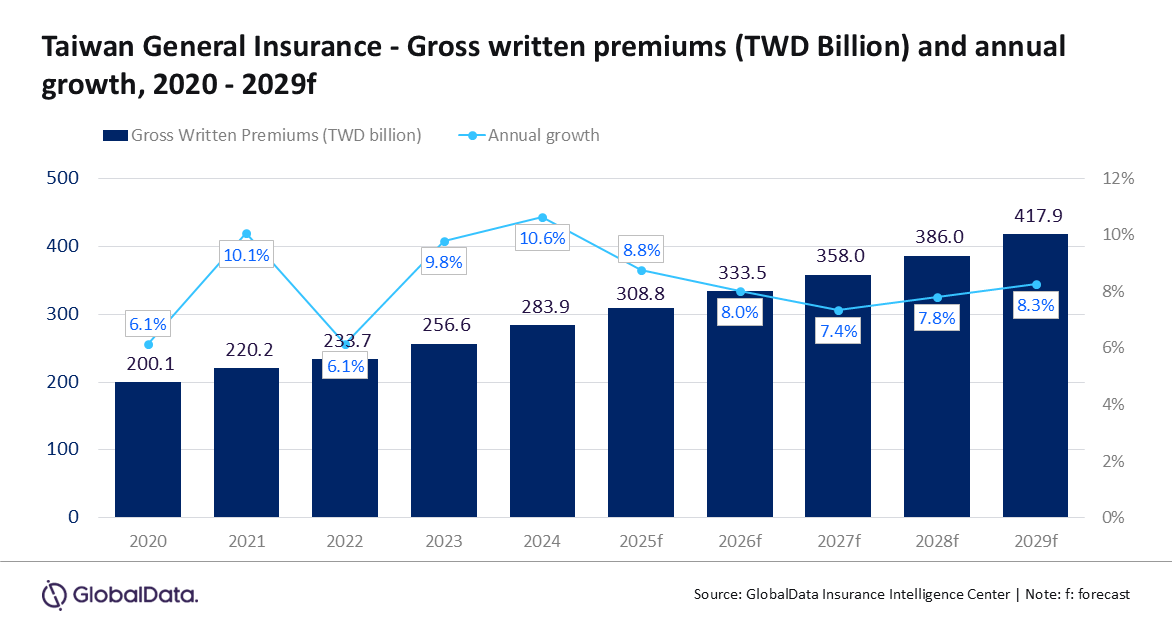

Taiwan’s general insurance industry is expected to grow at a compound annual growth rate (CAGR) of 7.9%, reaching $13.1b (TW$417.9b) in gross written premiums (GWP) by 2029, up from $9.7b (TW$308.8b) in 2025, according to GlobalData.

The market is projected to expand by 8.8% in 2025, supported by rising demand for high-premium electric vehicle (EV) insurance, recovery in auto sales, higher property risk awareness after recent earthquakes, stronger household spending, and continued digital reforms.

Motor, property, and personal accident and health (PA&H) insurance are expected to make up 82.8% of the sector’s GWP this year.

“Motor, property, and PA&H insurance remain key growth engines in Taiwan’s general insurance landscape,” Swarup Kumar Sahoo, Senior Insurance analyst at GlobalData said in a report.

Motor insurance accounts for 48.5% of GWP in 2025, the largest segment.

Growth is expected to slow slightly to 6.2% due to weaker new car sales, though steady demand is anticipated from mandatory coverage, EV-specific plans, and urban policyholders.

Taiwan’s introduction of EV insurance pricing rules in July 2024—capping premiums at no more than 50% higher than gasoline vehicle rates—is also expected to support confidence.

Property insurance is the second-largest segment, with a 25.1% share of GWP in 2025.

Heightened awareness of catastrophe risk following major earthquakes in April 2024 and January 2025 is expected to drive demand for fire and natural hazard coverage.

GlobalData forecasts property premiums to grow at a CAGR of 11.8% between 2025 and 2029, the fastest among all lines.

PA&H insurance, accounting for 9.2% of GWP, is projected to grow at a CAGR of 5.4% over the same period, supported by higher medical costs, an ageing population, and greater demand for supplemental health protection.

Other lines, including financial, liability, and marine, aviation, and transit insurance, will account for the remaining 17.2% of the market.

“Taiwan’s general insurance market presents a favourable outlook supported by economic growth, demographic shifts, technological innovation, and preparedness for catastrophes,” Sahoo said.

“Insurers are expected to strengthen underwriting discipline, expand digital distribution, and enhance customer engagement to meet evolving demands. External shocks, such as climate change and healthcare inflation, will continue to drive product innovation, with insurers focusing on resilience, solvency, and profitability,” concluded Sahoo.

Advertise

Advertise