What will drive the APAC life insurance market to bag $2t in five years?

India and China are major drivers of the sector’s growth.

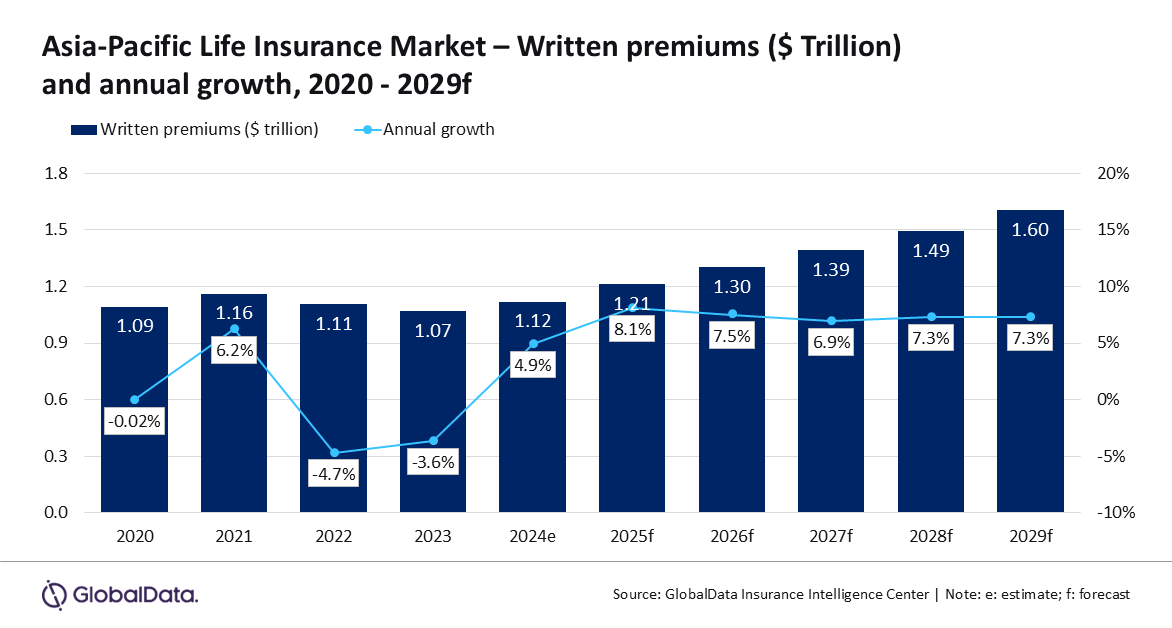

The Asia-Pacific life insurance market is expected to expand steadily over the next five years, with written premiums projected to rise from an estimated $1.2t in 2025 to $1.6t in 2029, according to GlobalData.

This reflects a compound annual growth rate of 7.3%. The region is expected to account for 32.4% of global life insurance written premiums in 2025.

GlobalData said growth will be supported by China and India, which remain the only developing markets ranked amongst the world’s top 10 life insurance markets.

China’s life insurance premiums are forecast to grow at a CAGR of 9.3% over 2025–29, increasing from $501.9b to $717.0b.

The report noted that China’s growth will be influenced by distribution reforms, lower interest rates and developments in the pension market.

New regulations, including a tiered agent system that will take effect in 2026 and stricter bancassurance rules introduced in 2024, aim to curb mis-selling and excessive commissions whilst supporting new business growth, particularly for larger insurers.

Chinese insurers have also lowered guaranteed returns on policies following several interest rate cuts since 2023, resulting in a shift toward participating plans, although adoption remains slow.

The rollout of private pensions in late 2024 is expected to stimulate China’s capital markets and encourage innovation in retirement products.

India’s life insurance market is projected to exceed $169b by 2029, growing at a CAGR of 9.0%.

Growth will be driven by regulatory reforms, wider participation from women and marginalised groups, and continued expansion of microinsurance schemes such as Bima Vistaar.

Industry premiums are also expected to benefit from favourable changes, including the increase in the FDI limit to 100% and the reduction of GST on life insurance to 0%.

GlobalData added that mature markets such as South Korea, Hong Kong, Japan and Taiwan are seeing increased demand for senior-focused products due to ageing populations. In 2025, more than 20% of people in Japan and South Korea are aged 65 or older. This share is forecast to reach 32.3% in Japan and 30.8% in South Korea by 2030.

Insurers across the region are developing indexed universal life products, legacy planning solutions and trust-based payouts to capture rising demand from high-net-worth individuals.

China’s HNWI population is expected to grow from 4.8 million in 2025 to 5.9 million by 2029, at a CAGR of 5.5%.

Manogna Vangari, Insurance analyst at GlobalData, said insurers that effectively use AI and tailor offerings to older customers and high-net-worth clients will be better positioned to manage economic headwinds and capture growth opportunities.

Advertise

Advertise