Insurers must expand cyber protection as Singapore shipowners upgrade security

Insurers must update underwriting as cyber navigation disruptions rise.

Singapore’s marine insurers face higher costs as GPS spoofing and jamming incidents climb across key shipping lanes, a trend that is compelling shipowners to strengthen cybersecurity on vessels and prompting underwriters to overhaul how they price and model digital risk.

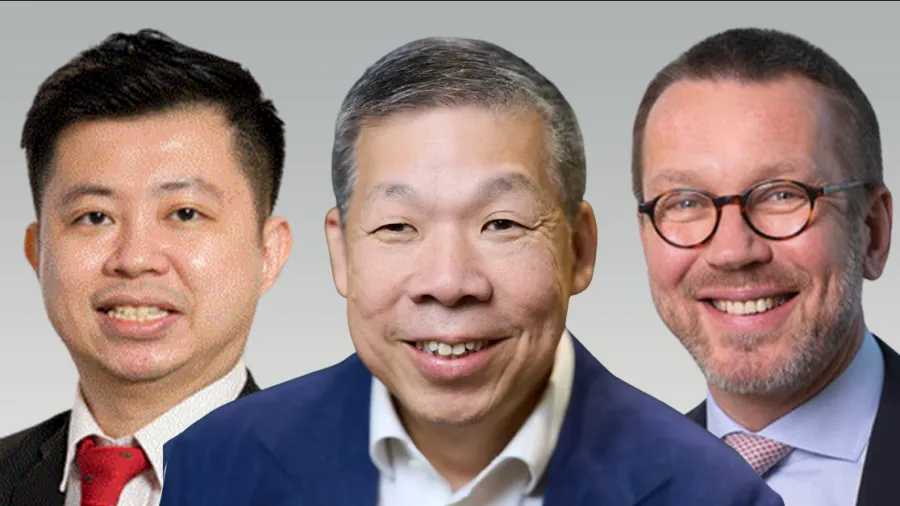

“Digitalisation is impacting almost all industries and business sectors,” Lars Lange, secretary general of the International Union of Marine Insurance (IUMI), told Insurance Asia in an emailed reply to questions. “Marine insurance has, on the whole, been relatively slow to adopt technologies, but inroads are being made.”

Insurers, he said, are updating underwriting processes as cyber-related navigational disruptions become more frequent.

Shipowners are under growing pressure to deploy stronger digital safeguards as spoofing events spread across the Middle East, the Black Sea and parts of Southeast Asia.

The Singapore Shipping Association’s (SSA) Singapore Cyber Insurance for Safe Shipping and Operational Readiness (SCISSOR) programme is among the initiatives filling the protection gap.

The product provides cyber cover that traditional marine policies typically exclude, such as ransomware damages, operational downtime from attacks, and theft linked to system breaches.

SSA President TS Teo said shipowners increasingly view cyber protection as a core operational requirement. The group also launched the SCISSOR Index, a cybersecurity scorecard that lets companies benchmark their preparedness and identify gaps.

“Such attacks can lead to severe consequences—we have seen a surge of cases such as GPS spoofing and jamming in 2025, incidents that can cause vessels to collide or run aground, posing significant risks to vessel and crew safety,” he said in an emailed reply to questions.

Teo added that insurers themselves should improve their digital capabilities to keep pace. He noted that tools that enhance underwriting accuracy or streamline claims would help insurers respond more quickly and operate more efficiently.

Global marine insurance premiums reached $39.92b in 2024, up 1.5% from the previous year, IUMI said in a recent report. It flagged geopolitical risks, a weak US dollar, pressures from fleet decarbonisation and ageing vessels as additional challenges.

Lange said the long-term rise in premiums reflects both higher shipping activity and the expansion of the global fleet. Singapore has seen cargo premiums climb roughly 50% over the past decade.

The shift toward cleaner fuels is creating another layer of complexity for both shipowners and insurers.

“From a hull and machinery underwriter’s perspective, the shift toward alternative marine fuels like methanol, ammonia, biofuels, and electric propulsion introduces both risk and opportunity,” Alex Lim, a senior underwriter at QBE Insurance Group, said in an email.

“Methanol and ammonia pose significant safety concerns due to their toxicity and flammability, requiring careful assessment of bunkering procedures, crew training, and onboard containment systems,” he added. Battery-powered vessels also carry risks tied to thermal runaway and charging systems.

Singapore is trying to smooth the transition by developing bunkering standards for methanol, ammonia and other fuels. But insurers say risk models will need continuous refinement as adoption widens. Underwriters are increasingly working with shipowners to understand vessel-specific hazards and craft coverage that reflects new technologies.

The government is also investing in talent development to support the industry’s long-term growth. Programmes such as the Marine and Port Authority Global Internship Award aim to draw younger professionals into marine insurance to maintain Singapore’s position as a leading hub for expertise and innovation.

Lange said the city-state has become a major driver of industry developments and is poised for continued growth.

Advertise

Advertise