What will drive Malaysia’s life insurance market to bag $20.4b by 2029?

Policy ownership has increased from 41.5% in 2019 to 45.5% in 2024.

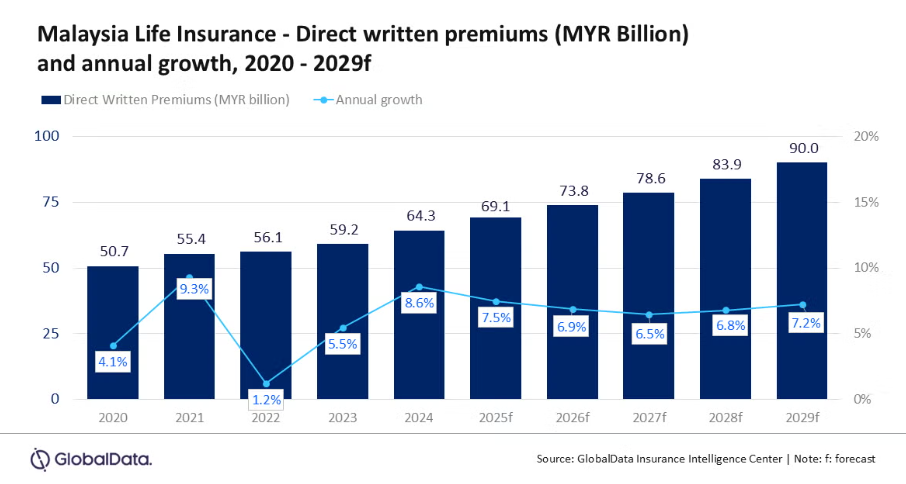

Malaysia’s life insurance market is expected to reach $20.4b in direct written premiums (DWP) by 2029, up from $15.6b in 2025, according to data from GlobalData.

This represents a compound annual growth rate (CAGR) of 6.8%.

GlobalData projects that the market will expand by 7.5% in 2025, supported by steady demand for protection-based and savings-linked products.

Rising household incomes, greater digital adoption amongst insurers, and government measures to boost financial inclusion are also expected to drive growth.

Policy ownership amongst Malaysians has increased from 41.5% in 2019 to 45.5% in 2024, reflecting greater awareness of financial protection.

Government initiatives such as the Perlindungan Tenang framework continue to support inclusion, with more than 530,000 subscriptions to microinsurance and microtakaful products recorded in 2024.

The insurance sector’s digitalisation push gained momentum in January 2025, when Bank Negara Malaysia introduced a regulatory framework for Digital Insurance Technology Operators (DITOs) under its Financial Sector Blueprint 2022–26.

The framework aims to improve efficiency and accessibility in the market, and the opening of DITO license applications has drawn strong interest from industry players.

Endowment insurance remains the largest segment, accounting for 78% of the life insurance DWP in 2025.

It is projected to grow at a CAGR of 6.9% between 2025 and 2029, driven by demand for products that combine savings and protection features.

Investment-linked policies are also gaining traction, with new business premiums up 24.8% in 2024, reflecting growing consumer preference for products that offer both coverage and wealth-building potential.

Whole life insurance is expected to be the second largest segment, representing 7% of total DWP in 2025.

Demand for these products is likely to increase alongside Malaysia’s aging population, which is driving interest in long-term financial and retirement planning.

Term life and other life insurance products make up the remaining 15% of the market.

GlobalData said the outlook for Malaysia’s life insurance industry remains positive, supported by regulatory reforms, digital innovation, and rising consumer awareness.

“Insurers that prioritize innovation and customer-centric offerings are likely to capture a larger market share, ensuring a resilient and competitive insurance landscape in Malaysia,” Swarup Kumar Sahoo, Senior Insurance analyst at GlobalData said in a report.

Advertise

Advertise