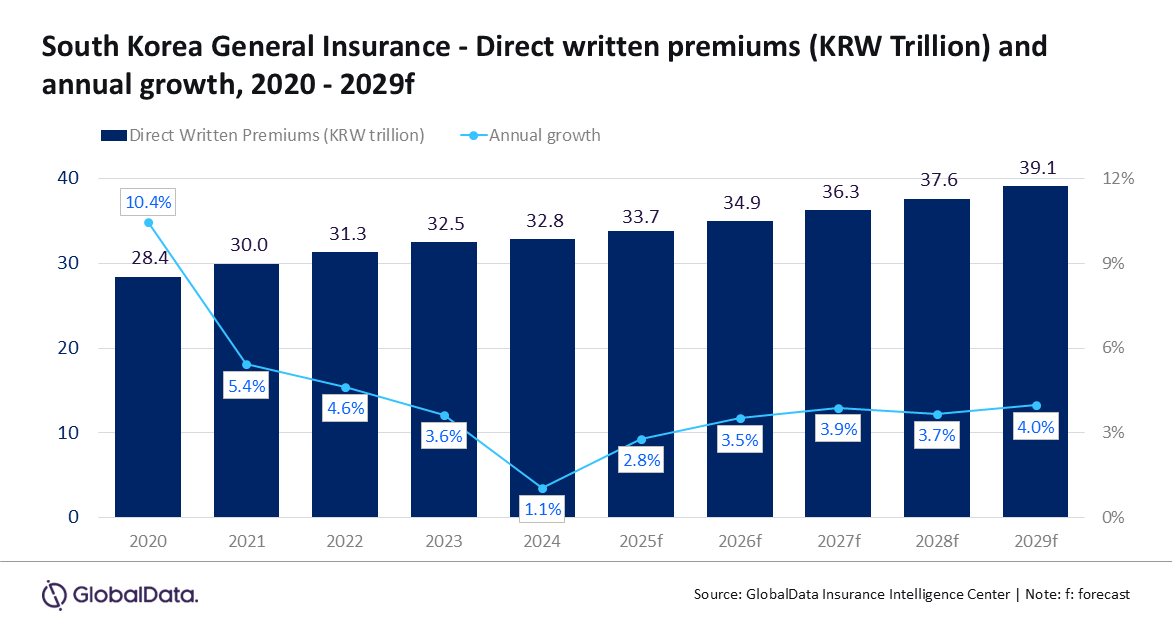

South Korea’s general insurance sector bound for 3.8% CAGR through 2029

Motor insurance will account for 58.7% of direct written premium (DWP) in 2025.

South Korea’s general insurance market is slated to grow 2.8% this year, driven by a surge in liability premiums that reflects a stricter compliance frameworks, GlobalData said.

The analytics company also forecasts a compound annual growth rate of (CAGR) 3.8% from 2025’s $25.1b to 2029’s $29.1b, in terms of direct written premium (DWP).

Oversight by the Financial Services Commission (FSC) and the Financial Supervisory Service (FSS), along with demographic factors such as an aging population, are expected to support long-term growth.

"Motor, liability, and personal accident and health insurance remain key growth engines in Korea’s general insurance landscape. The revival in vehicle sales and tightening regulations, including data protection regulations, have collectively triggered demand in these lines,” Swarup Kumar Sahoo, Senior Insurance analyst at GlobalData said in a report.

Motor insurance will account for 58.7% of direct written premium (DWP) in 2025.

The segment is forecast to grow at a CAGR of 1.9% between 2025 and 2029, supported by rising vehicle sales, higher traffic accidents, increased premium rates, and regulatory protections.

Automobile sales rose 5.8% in June 2025, with electric vehicles making up 52% of total sales in May.

Insurers have responded with new products covering battery damage and risks tied to roadside charging.

Liability insurance is expected to hold a 13.5% market share in 2025, with premiums growing at a CAGR of 6.0% through 2029.

Growth will be supported by new regulations, including the Act on the Protection of Virtual Asset Users, which requires liability cover for virtual asset service providers, and revisions to the Personal Information Protection Act, which mandate insurance against data breaches for more organisations.

Personal accident and health insurance will account for 7.8% of DWP in 2025 and is forecast to grow at a CAGR of 9.3% from 2025 to 2029.

Demand will be supported by an aging population, rising healthcare costs, and flexible product offerings.

By 2025, 20.8% of South Korea’s population will be aged 65 and older. The introduction of sliding-scale premiums for medical expense insurance from July 2024 is also expected to boost growth.

Other lines, including financial, property, and marine, aviation and transit, will make up the remaining 20% share of the market in 2025.

"The outlook for South Korea’s general insurance industry remains positive, with a projected acceleration in premium growth over the next five years,” Sahoo said.

“Continued focus on healthcare resilience, liability protection, and technology-driven motor coverage will define the sector’s trajectory. Whilst competition will intensify, insurers with strong underwriting discipline and digital capabilities are likely to secure long-term growth and profitability,” added Sahoo.

Advertise

Advertise