South Korea’s motor insurance grows 2.4% in 2025 with rate hikes

Motor insurance remains the largest segment in the general insurance industry.

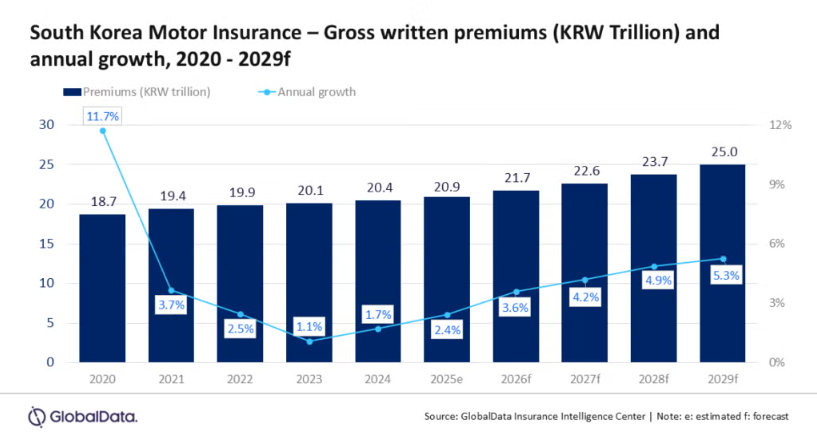

South Korea’s motor insurance sector will likely grow by 2.4% this year, according to GlobalData.

This growth is supported by a recovery in motor third-party liability (MTPL) insurance after three consecutive years of decline, higher vehicle sales, and an increase in premium rates. MTPL accounts for 12.8% of the total motor insurance GWP, while comprehensive motor insurance makes up the remaining 87.2%.

Furthermore, the industry is projected to grow at a compound annual growth rate (CAGR) of 4.5%, rising from $15.6b in 2025 to $18.6b in 2029 in terms of gross written premiums (GWP).

Motor insurance remains the largest segment in South Korea’s general insurance industry, contributing 58.3% of total general insurance GWP in 2024.

Its growth had slowed in recent years due to a drop in new vehicle sales, but this trend is reversing as new car sales recover and premium rates rise.

Premiums are expected to increase further in 2025, driven by higher loss ratios resulting from more frequent traffic accidents and increased labor costs.

Data from the Financial Supervisory Service (FSS) show that the average motor insurance loss ratio of the top four non-life insurers rose to 92.4% in November 2024, up from 81.5% a year earlier.

Traffic accidents also increased from 1.78 million in the first half of 2023 to 1.84 million in the same period of 2024, and this trend is expected to persist, keeping loss ratios above 80% in 2025 and 2026.

Insurers are also adjusting to the growing share of electric and hybrid vehicles, which come with higher premiums due to risks such as battery fires and elevated repair costs.

EV sales rose by 47% in the third quarter of 2024 compared to the same period in 2023, according to the Korea Automobile Manufacturers Association.

The government’s goal is for all new cars sold in the country to be electric by 2040.

Despite premium increases, the market faces pricing pressure due to the rising popularity of usage-based insurance and online distribution channels, which has created a soft market environment and squeezed profit margins.

“The future outlook for the South Korean motor insurance market appears positive, driven by regulatory reforms and the growing adoption of EVs. Additionally, increasing traffic accidents are expected to drive the demand and support the growth of motor insurance during 2025-29,” Swarup Kumar Sahoo, Senior Insurance analyst at GlobalData said in a report.

Advertise

Advertise