Japan life premiums grow 5.4% CAGR amidst yield volatility

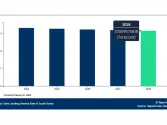

Gross written premiums are projected to reach $334b by 2030 following a 2024 contraction.

The life insurance market in Japan is seen to register a compound annual growth rate (CAGR) of 5.4% through 2030 in terms of gross written premiums (GWP), according to GlobalData.

The industry is likely to bag $266.2b this year and $337.7b in 2030. GlobalData also said in a report that Japan will likely pencil 1.7% in 2025, then pick up to 3.4% in 2026, supported by higher credited yields on new life policies, ongoing capital optimisation (including reinsurance), and rapid digital distribution gains.

Katam Prasanth, insurance analyst at GlobalData, said the projected growth in 2026 follows a contraction in 2024 and indicates stabilising conditions.

“Stronger sales of yen-denominated life policies have offset weakness in foreign-currency products, supporting topline stability into 2025 and establishing a stronger base for 2026,” Prasanth said.

Rising Japanese government bond yields have also influenced insurers’ investment strategies.

The maximum 40-year JGB yield increased from 3.34% in January 2025 to 3.56% as of 25 November 2025 after the finance ministry raised issuance to partly fund a $135b economic package.

Life insurers have responded by reducing domestic equity exposure and shifting towards higher-yielding fixed-income assets, whilst managing solvency and liquidity risks.

Prasanth said some insurers have also adopted hold-to-maturity accounting for parts of their JGB portfolios to limit mark-to-market volatility, enabling them to offer policies with more attractive interest rates and support demand.

Capital management and reinsurance are also becoming key areas of focus.

In March 2025, the Financial Services Agency tightened oversight of offshore life reinsurance arrangements, particularly those involving Bermuda-based structures, as insurers increasingly use reinsurance to improve capital efficiency under evolving regulations.

Demographics are expected to remain a key driver of long-term demand. Japan’s population aged 65 and above is projected to reach 32.3% by 2035, pushing the old-age dependency ratio to 53.1% from 50% in 2023.

Despite declining birth rates, demand for protection, annuities and health riders is expected to stay strong as retirement readiness gaps persist.

Regulatory changes may also affect participation. Japan plans to introduce stricter rules linking foreign residents’ status with records for health insurance and pension payments, with full implementation targeted by June 2027.

This is expected to improve compliance and could influence uptake of third-sector health and related riders within life insurance products.

At the same time, insurers and insurtech firms are investing in digital tools and artificial intelligence to improve underwriting, servicing and claims processing. Digital distribution, including embedded insurance and partnerships, is also expanding, whilst brokerage consolidation is expected to lower acquisition costs and widen reach.

“Looking forward, Japan’s life insurance sector growth is expected to stabilise over the next five years,” Prasanth said.

He added that although investment volatility and regulatory scrutiny remain risks, profitability, capital strength and innovation should allow Japanese life insurers to maintain growth and expand coverage.

Advertise

Advertise