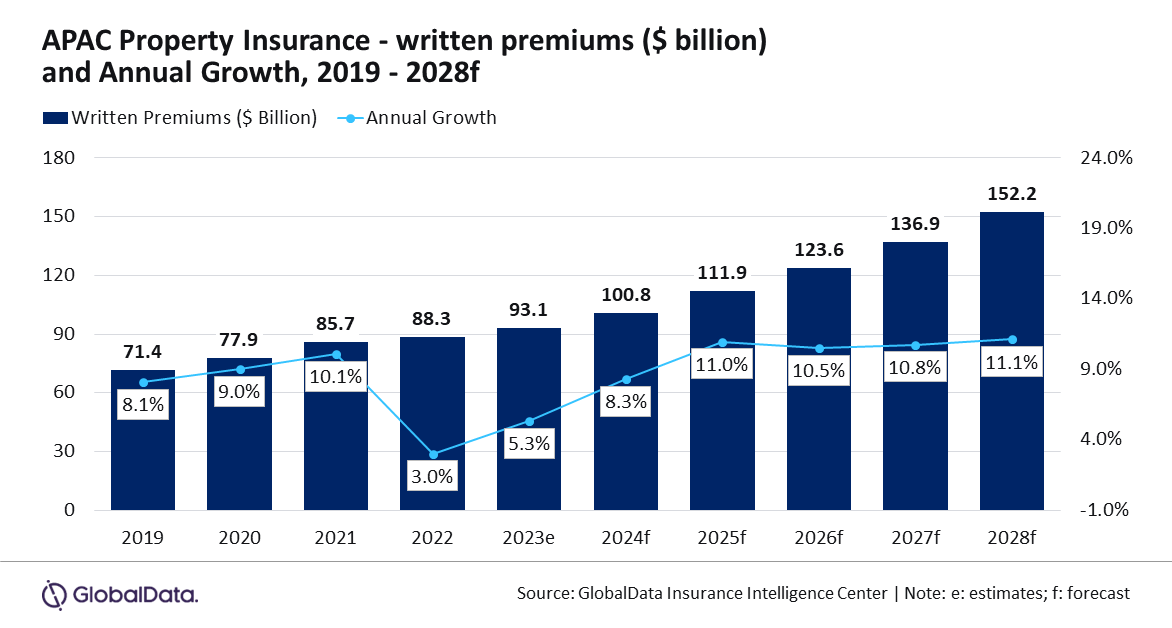

Property insurance industry to exceed $152b by 2028

China is forecast to lead with 36% in terms of written premiums.

Asia Pacific’s (APAC) property insurance industry is forecasted to bag a compound annual growth rate (CAGR) of 10.8% from ~$93.1b in 2023 to $152.2b in 2028, according to GlobalData.

APAC's property insurance market is set to outpace the global average growth rate, which is projected at 8.1% CAGR from 2024 to 2028.

The region's market is concentrated in China, Japan, and Australia, which are expected to collectively account for 75.2% of the region’s written premiums in 2024.

China is forecast to lead with 36%, followed by Japan at 23.5%, and Australia at 15.7%.

Aarti Sharma, Insurance analyst at GlobalData notes that disciplined underwriting practices and rising premiums for fire and home multi-risk property insurance will drive 8.3% growth in the APAC property insurance market in 2024.

“Favourable regulatory changes and the adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in risk assessment and streamlining the claims process will further fuel the growth of the industry,” Sharma said.

Natural disasters continue to impact the market. In Australia, storms in New South Wales and Queensland in April 2024 resulted in 19,938 claims with an economic loss of $182.4m, while a February 2024 storm in Victoria caused more than 27,000 claims with losses totalling $139.8m.

In Japan, worsening losses from natural hazards prompted the General Insurance Rating Organisation to raise fire insurance rates by 5.5% in 2018 to 13% in 2023.

Increased demand for fire and home multi-risk insurance policies is driven by heightened awareness of financial risks from natural disasters.

However, insurers are likely to limit coverage for high-risk areas due to rising reinsurance costs and poor loss ratios.

“Data analysis using AI is helping insurers generate sales leads. Virtual assistants and chatbots are guiding customers through the buying process and helping to interact with customers, offering information on policies and claims status, leading to higher efficiency,” Sharma said.

Insurers are using AI for data-driven risk assessment and customer interaction, improving efficiency in policy sales and claims handling. Meanwhile, regulatory changes, such as China’s push for green insurance and Australia’s additional funding for disaster preparedness, are also shaping the market.

“Premium price increases in fire and home multi-risk due to increased reinsurance costs and exposure to nat-cat events will support the growth of property insurance in APAC over the next five years. Insurers will need to adapt to the changing dynamics of AI and ML and focus on portfolio adjustments to limit high-severity loss exposure while maintaining profitability,” added Sharma.

Advertise

Advertise