IPO market rebounds to $2.54b in 2025, driven by ‘blockbuster’ REITs

Deloitte highlights two secondary listings, regulatory reforms.

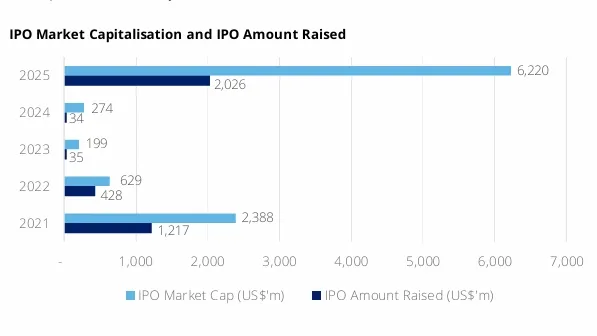

Singapore led Southeast Asia’s initial public offering (IPO) market by proceeds, as 13 IPOs raised $2.54b (US$2.0b) with a market capitalisation of $7.87b (US$6.2b) in 2025, driven by a stronger pipeline of Mainboard listings and two notable secondary listings.

The city-state’s previous highest IPO record within five years was in 2021, when it accounted for about $1.52b (US$1.2b) in proceeds and $3.05b (US$2.4b) in market capitalisation from eight IPOs, a Deloitte report said.

The market had a downward trend in proceeds starting in 2022, when it raised $543.56m (US$428m) in that year, whilst $44.45m (US$35m) in 2023, and $43.18m (US$34m) in 2024.

Market capitalisation for 2022 crashed to $798.83m (US$629m), whilst it further dipped to $252.73m (US$199m) in 2023, and had a slight rebound to $347.98m (US$274m) in 2024.

The report also showed that there were 11 IPOs in 2022, six in 2023, and four in 2024.

The real estate sector led the industry breakdown, raising $1.905b (US$1.5b) from four IPOs, which is 76% of Singapore’s total funds raised.

The sector is followed by the Life Sciences & Health Care sector with $508.00m (US$400m) from one IPO, and Technology, Media & Telecommunication with $60.96m (US$48m) from one IPO.

Other sectors include Consumers with $34.29m (US$27m) from five IPOs, Energy & Resources with $13.97m (US$11m) from one IPO, and Industrial Products with $6.35m (US$5m) from one IPO.

The Deloitte report also cited two “blockbuster” listings—namely NTT DC REIT and Centurion Accommodation REIT—which raised more than $635.00m (US$500m) each, accounting for 70% of Singapore’s total funds raised.

It also noted two secondary listings—China Medical Systems and Avepoint, Inc.—whilst cross-border listings include those from NASDAQ and Hong Kong Exchange Listings.

The Monetary Authority of Singapore (MAS) and Singapore Exchange (SGX) issued reforms for a disclosure-based regime to enhance market attractiveness.

SGX also lowered the profit test threshold for Mainboard admission from $30m to $10m.

MAS also plans to enhance the appeal of dual listings in Singapore and on NASDAQ by providing a seamless pathway for companies seeking such.

The city-state’s gross domestic product is also poised for 1.4% growth, according to the report.

US$1 = SG$1.27

Advertise

Advertise