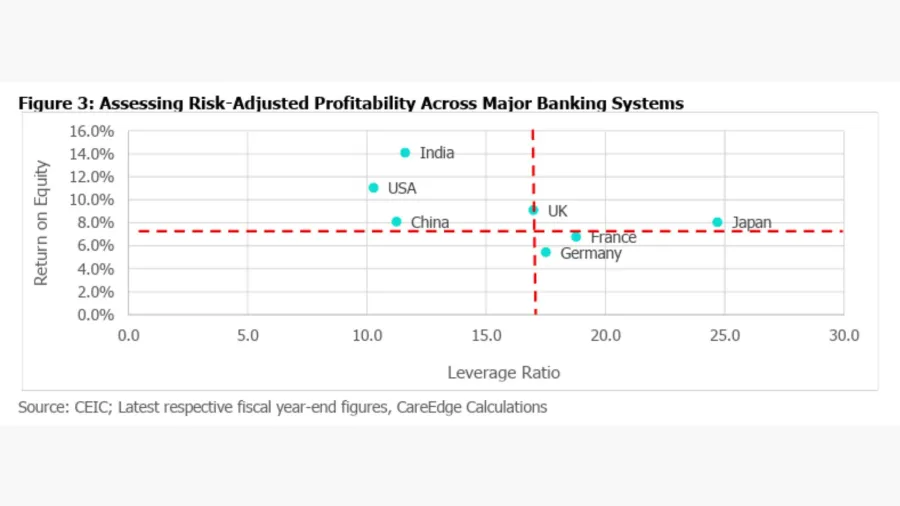

Indian banks outclass Western peers with high-return, low-leverage model

The study groups India where lower gearing aligns with higher performance.

India’s banking system is operating with lower leverage than many developed markets whilst delivering stronger returns, according to CareEdge Ratings.

The sector’s average gearing ratio stands at 11.6 times, which is materially below that of banks in Europe and Japan.

A comparison of global banking markets places India in a category where lower leverage coincides with higher returns, unlike developed markets that tend to show higher gearing alongside weaker profitability.

This suggests Indian banks are generating returns without heavy reliance on leverage, pointing to more efficient use of capital.

The analysis also shows that credit penetration in India remains low, indicating there is room for banks to expand their balance sheets without a corresponding increase in systemic risk.

Together, these factors support the view that India offers favourable conditions for long-term banking sector growth.

India’s overall banking sector has significant headroom for credit growth, making it attractive for foreign banks to expand operations in.

Banking margins remain relatively high despite a low bank credit-to-GDP ratio, according to a report published on 22 January 2026. Credit penetration in India also remains low.

This positioning suggests significant headroom for growth in India without the "leverage-driven" risks evident in more mature banking systems, it added.

“This structural advantage strengthens India’s attractiveness as a growth market. It supports the case for foreign banks to expand operations and establish regional centres to capture long-term credit growth opportunities,” CareEdge Ratings wrote.

Advertise

Advertise