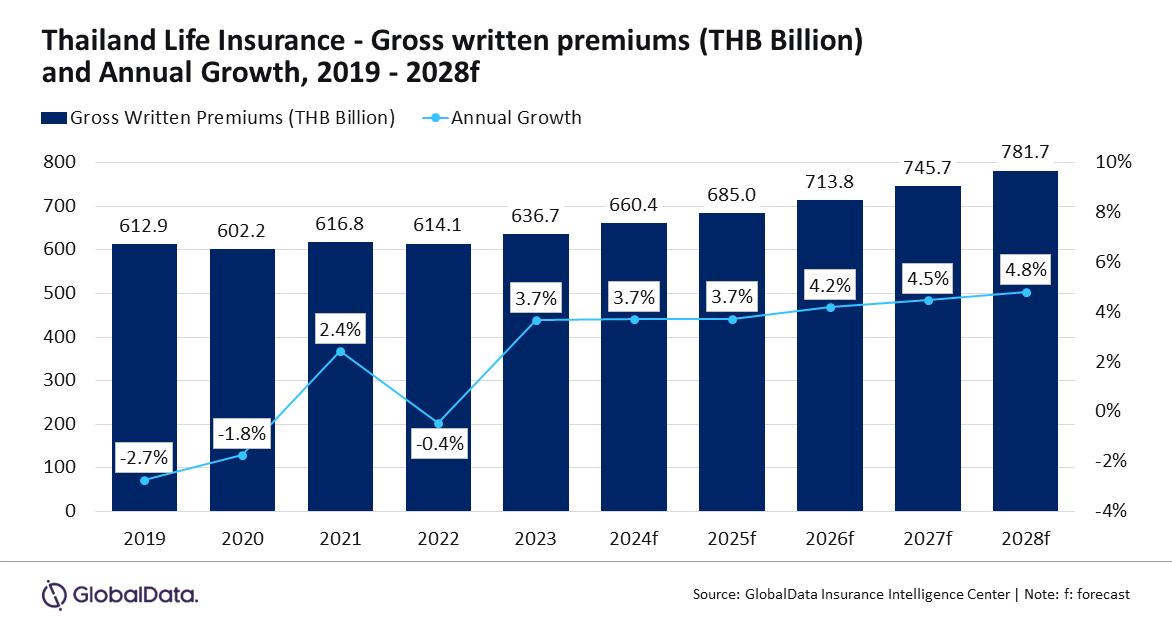

Thailand's life insurance industry slated for CAGR of 4.4% by 2028

In 2023 the sector grew by 3.7%.

Thailand’s life insurance sector is projected to reach a compound annual growth rate (CAGR) of 4.4% from $19.2b in 2024 to $23.1b in 2028. Meanwhile, this year is expected to remain flat at 3.7%.

“The life insurance market in Thailand is set to experience steady growth over the next five years, with demographic changes driving the demand for life insurance. Products catering to the growing needs of a rapidly ageing population are expected to be a focus area for insurers over the coming years.” Aarti Sharma, Insurance Analyst at GlobalData, said.

In 2023, the sector grew by 3.7%, supported by demographic shifts toward an ageing society and a growing expatriate population, revealed GlobalData.

Whole life insurance will dominate, with a 60.3% share of gross written premiums (GWP) in 2024. This segment is projected to grow at a CAGR of 3.7% from 2024 to 2028, reflecting the increase in average life expectancy from 77.9 years in 2023 to 79.6 years by 2030.

Supplementary or rider insurance is the second-largest line, expected to make up 22.3% of total GWP in 2024.

This segment, which includes health riders, is anticipated to grow at a CAGR of 5.4% over the same period.

The demand is driven by demographic changes and a growing expatriate population, with popular options including dental, vision, and premium health insurance plans.

Endowment insurance is forecasted to account for 5.2% of total GWP in 2024.

This line is expected to grow at a CAGR of 5.2% from 2024 to 2028, following a 4.3% increase in GWP for non-linked insurance products in 2023, as consumers shift towards products with guaranteed returns due to volatile financial markets.

Other life insurance lines, including pension, universal life, personal accident and health (PA&H), are expected to make up a combined 12.2% of GWP in 2024.

Advertise

Advertise