Malaysia’s life insurance market to hit $17.2b by 2028

Endowment insurance is projected to represent 77.3% of total DWP.

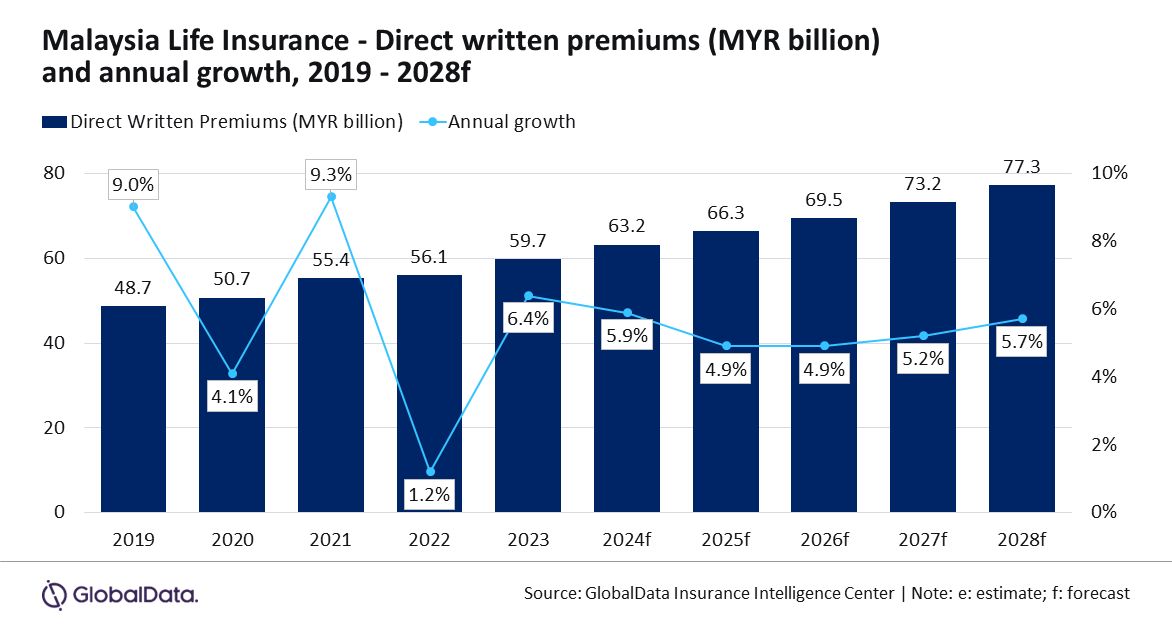

The life insurance market in Malaysia is forecast to reach $17.2b direct written premiums (DWP) in 2028, garnering a compound annual growth rate (CAGR) of 5.2% from 2024 to 2028, GlobalData results showed.

GlobalData also forecasts a 5.9% growth in Malaysia’s life insurance market in 2024, driven by increased consumer spending due to economic recovery, regulatory reforms promoting digitalization, and the ageing population.

“The Malaysian economy exhibited a robust growth of 4.2% in the first quarter of 2024 from the 2.9% growth recorded in the fourth quarter of 2023,” Manogna Vangari, Insurance Analyst at GlobalData said in the report.

“This growth was primarily attributed to heightened private expenditure and enhanced investment activities. As per GlobalData Macroeconomic forecast, the economy is further expected to grow at an annual average rate of 4.4% over 2024–26, which will support the growth of life insurance,” added Vangari.

Endowment insurance, the sector’s largest segment, is projected to represent 77.3% of total life insurance DWP in 2024.

Following a 7.8% rise in linked insurance premiums and a 4.4% increase in non-linked premiums in 2023, demand for endowment insurance is expected to grow at a 5.1% CAGR from 2024 to 2028.

“Favorable regulatory reforms will also support life insurance growth. In July 2024, the Central Bank of Malaysia released a comprehensive Policy Document on Licensing and Regulatory Framework for Digital Insurers and TakafulOperators, aiming to foster the digital transformation of the insurance sector,” said Vangari.

“This framework is part of the Financial Sector Blueprint 2022–2026, which seeks to promote inclusion, competition, and efficiency through digitalisation,” she added.

Whole life insurance, accounting for a projected 7.5% share of DWP in 2024, is expected to grow by 2.3% that year, fueled by Malaysia’s ageing population.

The proportion of Malaysians aged 65 and older is projected to rise from 8.1% in 2023 to 8.7% in 2025, with the old-age dependency ratio expected to increase from 11.7% to 12.6% over the same period. Whole life insurance is set to grow at a 1.9% CAGR from 2024 to 2028.

Term life insurance, the third-largest segment, is projected to hold a 4.4% share of DWP in 2024. Its premiums grew by 5% in 2023, down from 5.1% in 2022, reflecting consumer spending adjustments amid rising inflation.

Malaysian insurers have responded by offering low-cost plans under the i-Lindung program, a government-led initiative launched in July 2022 for affordable life and critical illness insurance.

The Life Insurance Association of Malaysia introduced the i-MULA 50 Starter Pack in August 2024 to provide affordable coverage to 100,000 eligible Malaysians. Term life insurance is expected to grow at a 4.9% CAGR over 2024–28.

Other life insurance products are anticipated to comprise the remaining 10.8% of DWP in 2024.

“Favorable regulatory reforms will help in increasing the life insurance penetration rate in Malaysia (3.3%), which was lower as compared to other Asian markets such as Taiwan (9.3%), Japan (6.3%), and Thailand (3.5%) in 2023. Changing demographics and digitalization will prompt insurers to provide more competitive and tailored insurance policies that will help in improving the penetration rate,” added Vangari.

Advertise

Advertise