Japanese life insurers poised to surge $350b by 2028: GlobalData

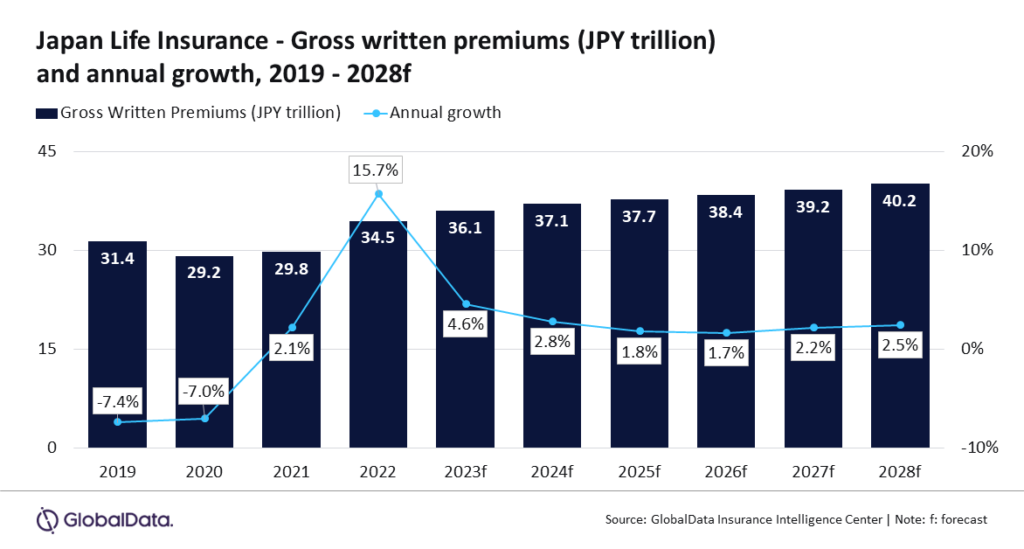

The industry should increase 4.6% in 2023.

The Japanese life insurance industry is projected to experience a compound annual growth rate (CAGR) of 2.0% to $359.5b in 2028 from $289b in 2024 in terms of gross written premiums (GWP), according to GlobalData.

“In Japan, agencies are a prominent distribution channel for life insurance products. The channel witnessed a dip in revenue in 2020 and 2021 due to the COVID-19 outbreak that limited face-to-face interaction, leading to slower industry growth,” Deblina Mitra, Senior Insurance Analyst at GlobalData commented.

Key factors contributing to this growth include the revival of agency distribution channels, continued demand for single premium foreign currency-denominated insurance products, regulatory interventions to enhance agency standards, and increased competition for short-term insurance market share.

ALSO READ: Japanese non-life insurers navigate uncertainty despite stable outlook: AM Best

Additionally, the introduction of a new review system by the Life Insurance Association (LIAJ) is expected to boost customer confidence and transparency in the agency channel.

“However, the Bank of Japan’s (BoJ) anticipated tightening monetary decision in 2024, where it is projected to end negative interest rates, may cause volatility in global capital markets. Any repercussions from this decision on foreign government bond yields or interest rates can influence foreign-currency insurance demand over 2024,” Mitra said.

The industry is also set to benefit from the popularity of single-premium foreign-currency-denominated insurance products and increased competition focusing on short-term protection-type policies. The simplified licensing process for short-term policies and their appeal to younger demographics contribute to the sector's positive outlook.

“Japan’s life insurance outlook over 2024-28 remains buoyant as insurers expand through agencies and launch innovative short-term insurance products. Insurers are expected to be cautious of the BoJ’s interest-rate decisions and their potential impact on global capital markets over 2024.” Mitra concluded.

Advertise

Advertise