How did top insurers by market cap perform in Q1 2025?

China’s PICC Property and Casualty led gains with a 40.5% rise in market value.

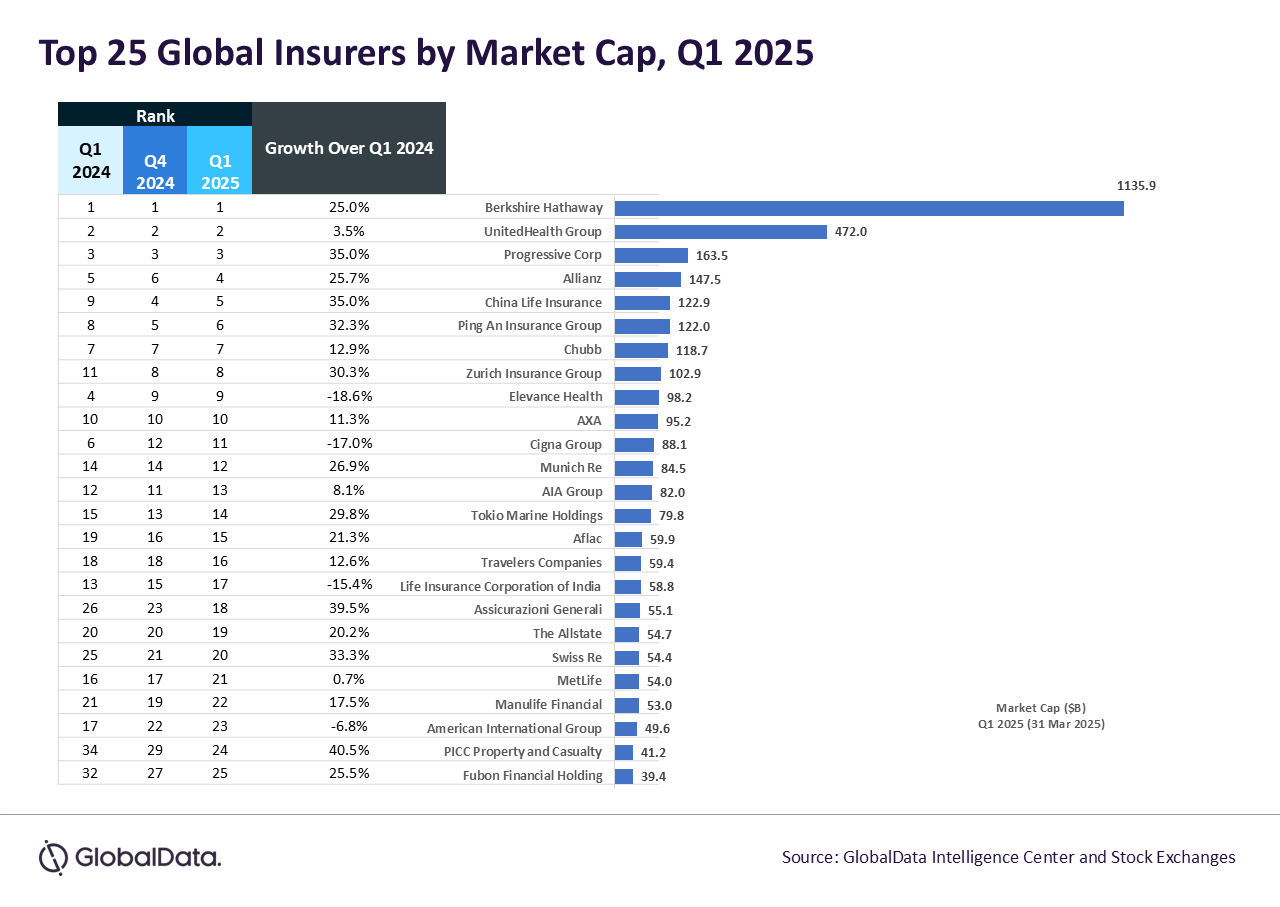

The combined market capitalisation of the world’s top 25 insurers rose 17% year-on-year to $3.5t in the first quarter of 2025, according to GlobalData.

The sector benefited from higher premium pricing amidst inflation, improved investment income due to elevated interest rates, and fewer large-scale catastrophic events during the period.

PICC Property and Casualty led gains with a 40.5% rise in market value, driven by strong 2024 results.

The company reported improved performance in motor and non-motor vehicle insurance segments and greater operational efficiency through technology-based cost controls.

PICC held a 38.8% share of China’s household motor vehicle insurance market.

Assicurazioni Generali’s valuation increased 39.5% to $55.1b by the end of March 2025.

Berkshire Hathaway saw a 25.7% increase in market value, supported by strong returns from energy and infrastructure investment.

In contrast, Elevance Health and The Cigna Group posted year-on-year declines of 18.6% and 17.0%, respectively, due to reduced enrollment, higher medical loss ratios, and regulatory scrutiny.

Life Insurance Corporation of India fell 15.4% as it faced weak policy growth, poor equity market performance in India, and limited foreign investment.

Looking ahead to the second quarter, GlobalData noted that the US Federal Reserve’s potential pause in rate hikes may help stabilise yields and support life insurers’ investment portfolios, according to Murthy Grandhi, Company Profiles analyst at GlobalData.

However, trade tensions between the US and China could weigh on global trade insurance demand.

Inflation and monetary tightening in Europe and Asia may compress margins, though repricing efforts could support premium growth.

Demand for specialty insurance lines, particularly in climate and cyber risks, is expected to grow.

Advertise

Advertise