Asian economies at higher financial risk from climate hazard intensification, warns report

The Swiss Re Institute emphasised insurance’s role in risk mitigation.

Climate change is expected to have a significant impact on economic losses in the future, with certain countries already highly exposed to weather-related hazards. Thus, risk reduction through adaptation can enhance insurability, with the insurance industry ready to play a crucial role by catalysing investments in adaptation projects and sharing risk knowledge.

“Climate change is leading to more severe weather events, resulting in increasing impact on economies. Therefore, it becomes even more crucial to take adaptation measures. Risk reduction through adaptation fosters insurability,” Jérôme Jean Haegeli, Swiss Re's Group Chief Economist said in a press release.

“The insurance industry is ready to play an important role by catalysing investments in adaptation, directly as a long-term investor and indirectly through underwriting climate-supportive projects and sharing risk knowledge. The more accurately climate change risks are priced, the greater the chances that necessary investments will actually be made.” Haegeli added.

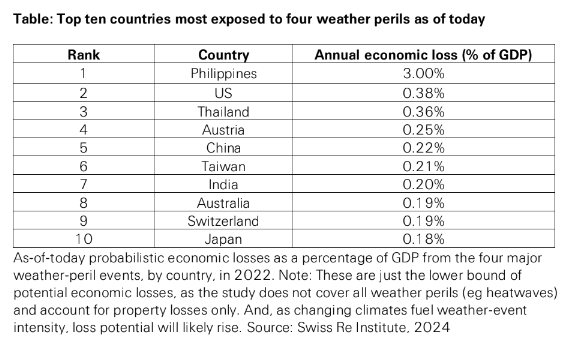

The Philippines and the US are ranked as the most economically exposed countries currently, with high probabilities of hazard intensification due to climate change, according to the Swiss Re Institute.

The Philippines stands out as the most impacted country by the four major weather perils of all 36 countries analysed, experiencing annual economic losses equivalent to 3% of GDP.

The US follows closely (0.38%), facing the highest absolute economic losses from weather events globally, particularly driven by tropical cyclones (hurricanes) and severe thunderstorms.

ALSO READ: Swiss Re targets $3.6b 2024 earnings after robust 2023 performance

Countries with substantial insurance protection gaps and slower establishment of mitigation and adaptation measures relative to economic growth are at higher financial risk from hazard intensification.

Fast-growing Asian economies like Thailand, China, India, and the Philippines are identified as particularly vulnerable.

Looking ahead, floods are projected to intensify globally, while tropical cyclones remain a significant driver of economic losses, especially in the US and parts of Asia.

Implementing adaptation measures such as enforcing building codes and increasing flood protection will be crucial in reducing loss potential and mitigating economic impacts.

Ultimately, the extent of future losses relative to GDP in each country will depend on the effectiveness of adaptation, loss reduction, and prevention efforts.

Data from the report "Changing climates: the heat is (still) on," combines findings from the Intergovernmental Panel on Climate Change (IPCC) with Swiss Re Institute.

Advertise

Advertise