Will reinsurers see price increases in 2025?

Nearly a third of respondents predicted price hikes of more than 5%.

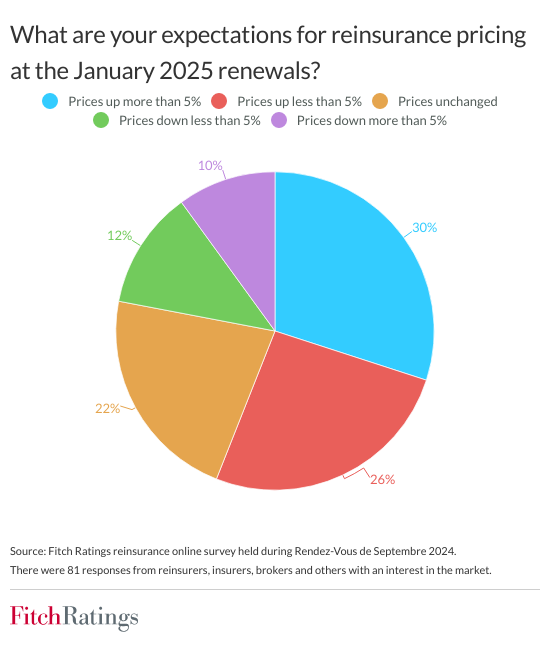

Reinsurers showed mixed expectations regarding pricing in 2025, with over half of reinsurers projecting prices to increase at the January 2025 renewals, according to Fitch Ratings.

This follows recent years of price increases driven by high claims inflation. Approximately 30% of respondents predicted price hikes of more than 5%, whilst 26% foresaw more moderate increases, Fitch’s survey conducted during the annual Rendez-Vous de Septembre in Monte Carlo showed.

The survey gathered responses from 81 industry participants including reinsurers, insurers, and brokers.

This follows recent years of price increases driven by high claims inflation. Approximately 30% of respondents predicted price hikes of more than 5%, whilst 26% foresaw more moderate increases.

However, 22% of respondents anticipated price declines—a view Fitch shares. The ratings agency believes the reinsurance pricing cycle has likely peaked, citing an abundance of sector capital.

As a result, Fitch revised its global reinsurance sector outlook from ‘improving’ to ‘neutral,’ suggesting a potential softening in the market come 2025.

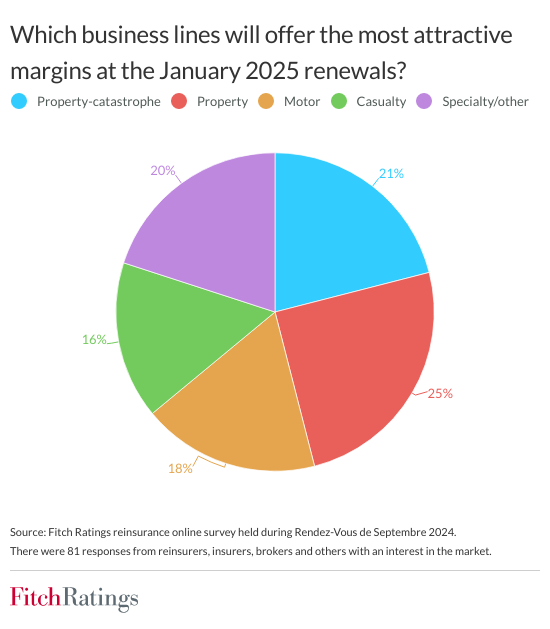

When asked about the most attractive business lines for margins in January renewals, responses were varied, with casualty being the least favoured at 16%.

This reflects the growing difficulty in managing rising casualty loss costs, particularly as social inflation pushes these expenses higher.

Fitch expects reinsurers to respond by pushing for double-digit increases in US casualty premium rates and adjusting cover limits and quota-share commissions.

Property and catastrophe (P&C) insurance also saw mixed sentiment. Whilst 39% of respondents believed pricing would adequately cover increasing loss trends in this area, 36% disagreed, and 25% were unsure.

Fitch, however, remains optimistic about reinsurers' ability to sustain strong profitability in P&C, even if prices ease. The agency points to strengthened capital buffers and improved reserve adequacy, bolstered by record profits in 2023 and the first half of 2024, as key factors.

Reinsurers are expected to maintain underwriting discipline and stringent terms to mitigate the risks of secondary peril events, which are becoming more frequent and volatile due to climate change.

Advertise

Advertise