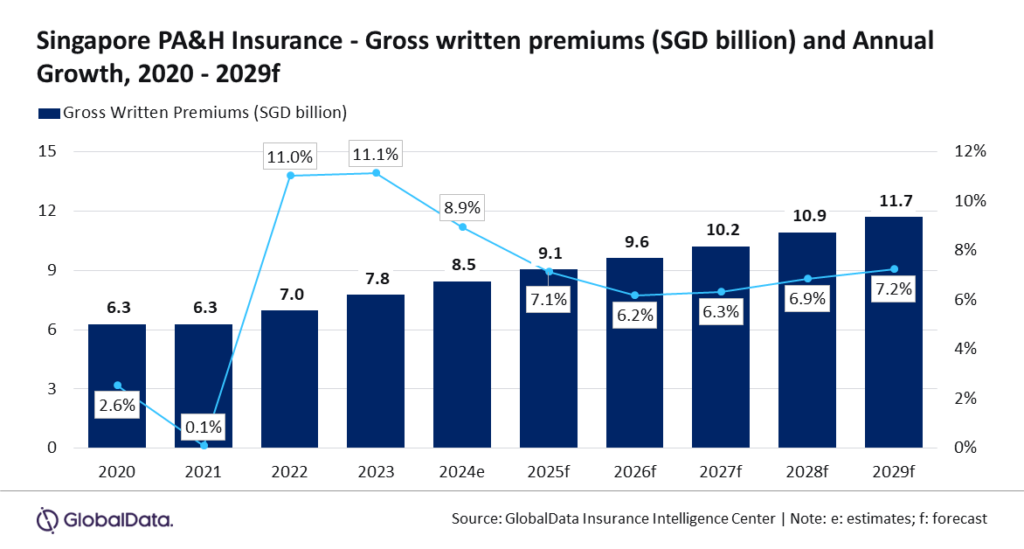

Singapore’s personal accident, health insurance market to exceed $8b by 2029

PA&H insurance is forecast to rise 8.9% in 2024.

Singapore’s personal accident and health (PA&H) insurance market is projected to grow at a compound annual growth rate (CAGR) of 6.6%, rising from $6.2b (S$8.5b) in 2024 to $8.6b (S$11.7b) by 2029, according to GlobalData.

The segment’s share of the total insurance industry is expected to increase from 15.3% in 2024 to 17.3% by 2029, driven by rising demand for private health insurance and premium adjustments.

In 2024, PA&H insurance growth is forecast at 8.9%.

“Singapore’s PA&H insurance has experienced a strong growth in 2024, bolstered by heightened health and financial awareness that spurred demand for health insurance products,” Aarti Sharma, Insurance analyst at GlobalData, said in a report.

“Demographic factors including an ageing population, premium price adjustments in response to inflation, and resurgence in tourism have also supported the growth of PA&H insurance,” Sharma added.

Integrated shield plans (IPs) and riders offered by private insurers have been key contributors, alongside Singapore’s MediShield Life program, which provides basic health insurance.

As of mid-2024, approximately 71% of Singapore’s population, or 2.9 million people, were covered by IPs, with new business premiums for individual health insurance growing by 7.1% year-on-year in the first half of 2024.

“The increase in premiums due to rising healthcare costs will also support the growth of PA&H insurance,” Sharma added.

In October 2024, Singapore’s Ministry of Health announced a 35% phased increase in MediShield premiums, effective April 2025, to accommodate expanded coverage, higher claim limits, and changes to deductibles and co-insurance.

The adjustments, capped at 35%, will be implemented by March 2028.

Demographic trends, including a growing elderly population, further support market expansion.

As of June 2024, nearly 20% of Singapore’s population was aged 65 or older. Additionally, increased tourism is contributing to growth.

International tourist arrivals rose 16.7% year-on-year in October 2024, boosting demand for travel insurance, which often includes personal accident coverage.

The outlook for Singapore’s PA&H insurance industry remains strong, driven by rising premiums, demographic changes, and increased tourism.

Insurers are well-positioned to capitalise on these dynamics and meet the growing demand for comprehensive health and accident coverage.

Advertise

Advertise