Income wins Singapore Digital Experience of the Year - Financial Services at the Asian Experience Awards 2022

The company’s financial proposition has been expanded to make products more accessible.

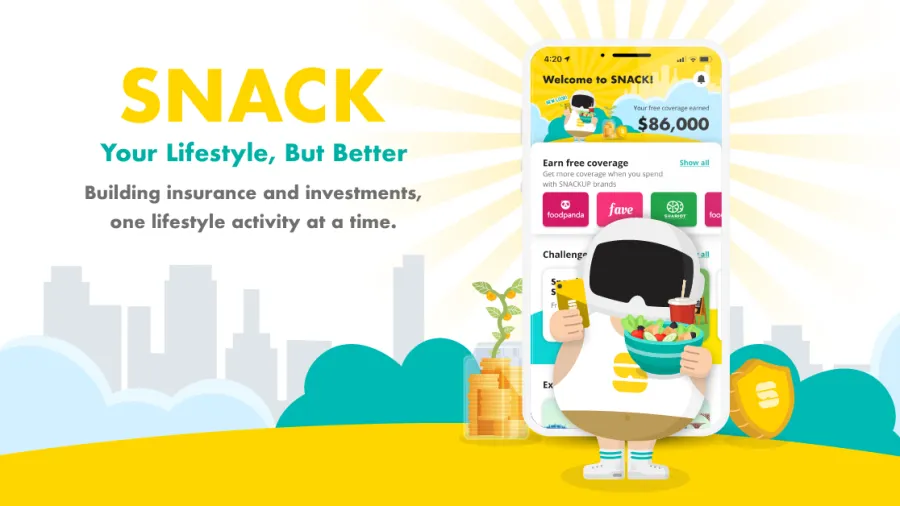

Financial services company Income Insurance Limited has brought home the Singapore Digital Experience of the Year - Financial Services accolade at the recently held Asian Experience Awards 2022 for its lifestyle-based financial proposition, SNACK by Income.

SNACK is the company’s innovative, industry-first proposition that revolutionises the way consumers engage with, purchase, and obtain insurance and investment in Singapore. In the last two years, it has expanded its proposition with the aim of making financial products more accessible through its suite of offerings.

Designed for the digital-first generation, who are largely first jobbers, millennials, and older Gen Zs, as well as the underserved segments consisting of gig economy workers, SNACK reimagines the conventional way of obtaining insurance and investments, making it ‘invisible’ and embedded into the lifestyle of our users. SNACK was first launched to allow users to gradually stack their insurance coverage for Term Life, Personal Accident, or Critical Illness by paying micro-premiums. A micro-policy is issued when a micro-premium is paid, covering the insured for 360 days.

Users can decide when and how frequently premiums are paid by linking them to their preferred lifestyle triggers, such as shopping, dining, or taking public transport, offering consumers new freedom and flexibility in protecting themselves just by going about their daily activities.

SNACKUP was subsequently launched together with Visa to expand SNACK’s proposition by allowing consumers to stack insurance coverage contributed entirely by merchants and participating brands when they spend with their Visa cards. With every transaction consumers make at participating brands, the merchant contributes $100 worth of insurance coverage to the consumer’s insurance portfolio on SNACK as "rebates,"’ akin to how merchants typically reward customers via points or cash rebates. This redefines the conventional channels of obtaining insurance, and also builds a community where these lifestyle SNACKUP brands can engage and build loyalty with consumers in a unique manner.

Up next is a first-of-its-kind fitness and lifestyle proposition, SNACKFIT, that offers bonus insurance coverage based on biological age. It is powered by ReMark’s Biological Age Model BAMTM , a proprietary dynamic underwriting algorithm where key health metrics retrieved from linked fitness trackers are used to calculate a person’s biological age. There are 5 metrics – Steps, Active Calories, Resting Heart Rate, Sleep Hours, and BMI, used to calculate a person’s biological age. The consumer will receive bonus insurance coverage on their micro policies if their biological age is lower than their actual age.

It ultimately encourages healthy lifestyles and empowers users to take control of their health and fitness, complementing NTUC Income’s growing ecosystem of fitness and health-related partners.

To further complement the company’s existing insurance products, SNACK Investment was launched to provide a more holistic financial planning experience, being the industry’s first micro investment-linked plan. It adopts a stackable approach that allows consumers to build their investment portfolios with bite-sized premiums as they go about their daily lives. Unlike conventional ILPs, SNACK Investment lowers the barriers to entry and offers flexibility since premiums start at $1 and users can invest, stop, and adjust premiums at anytime without any fees on the app.

Building on the concept of SNACKUP, Income introduced SNACKUP Investment to allow users to accumulate free investment credits ($0.20) for each transaction made with participating brands. It’s like cashback, but better! In the coming months, SNACK Investment will be expanded to allow greater flexibility to customers by allowing them to customise their portfolio through fund switching.

Ever since the expansion of SNACK’s proposition, Income has doubled both its active users and total sum assured to reach 80,000 users and $315m sum assured respectively in a short span of 10 months. With the goal of scaling its ecosystem, the company has also accumulated close to 1,500 touchpoints around the island.

The company believes all these signify an important milestone for them as they continuously strive to rethink how insurance and investments can be more simple, accessible, and convenient.

The prestigious awards programme aims to highlight the ingenious initiatives of creative companies delivering meaningful brand experiences to their stakeholders.

The Asian Experience Awards is presented by Asian Business Review Magazine. To view the full list of winners, click here. If you want to join the 2023 awards programme and be acclaimed for providing meaningful brand experiences to stakeholders, please contact Jane Patiag at [email protected].

Advertise

Advertise