What will drive the reinsurance sector to bag $68b in four years?

In 2023, APAC accounted for 13.3% of global reinsurance premiums.

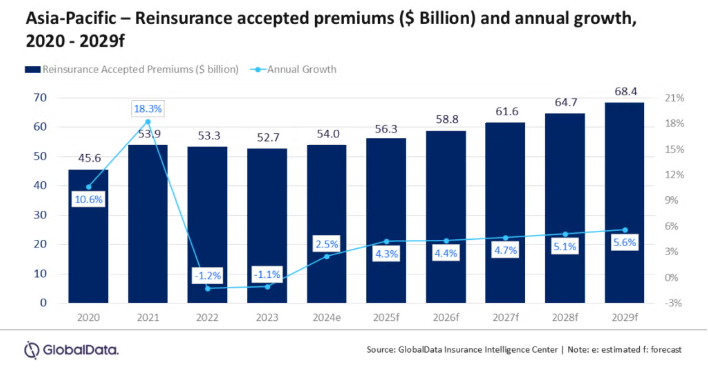

Asia-Pacific’s reinsurance industry is forecasted to bag $68.4b by 2029, registering a compound annual growth rate (CAGR) of 4.8% from 2024, GlobalData.

The region is estimated at $54b in 2024. The growth is supported by stable pricing and rising demand for catastrophe risk coverage.

In 2023, APAC accounted for 13.3% of global reinsurance premiums. The market has seen pricing stabilisation in 2024, a shift from the hard market conditions of the previous year.

Growth is being driven by both mature and fast-growing insurance markets within the region, alongside reinsurers' increasing appetite for underwriting catastrophe risks.

Regulatory developments are also contributing to market resilience. These include the adoption of risk-based capital regimes in Hong Kong (China SAR) and climate risk stress tests in Malaysia.

“The adoption of International Financial Reporting Standard 17 in countries like Japan and South Korea has led to stable returns on equity, further strengthening the market,” Swarup Kumar Sahoo, senior Insurance analyst at GlobalData said in a report.

“However, the region’s vulnerability to natural catastrophes and economic uncertainties poses challenges that reinsurers must navigate carefully,” Sahoo said.

However, exposure to natural catastrophes and regional economic uncertainties remainsa key challenge.

The APAC region is particularly vulnerable to climate-related events, requiring careful risk selection by reinsurers, Sahoo said.

The cyber insurance segment presents an additional growth avenue. Global cyber premiums are expected to rise 8% to $16.6 billion in 2025, but APAC currently accounts for only 8% of that market.

The protection gap offers substantial potential for expansion. In parallel, demand for agricultural and catastrophe cover in China is growing, aligned with broader primary market development.

Interest in Insurance-Linked Securities (ILS) is also growing, with Hong Kong (China SAR) positioning itself as a regional hub.

Whilst the full potential of ILS depends on deeper market development and increased investor participation, it is seen as a supportive factor for market stability.

Advertise

Advertise