How technology can help Southeast Asian life insurers close the protection gap, create new revenue streams

Digital transformation is crucial to address these challenges through digital distribution, microinsurance, big data, AI, telematics, and modern IT systems.

To meet the challenges of market reality, the life insurance industry in Southeast Asia needs to be digitally transformed. The most important steps seem to be entering new customer segments, transforming distribution, and modernising product modelling by making it simpler, customised, and affordable.

Where are Southeast Asian life insurers going?

Beginning with some background general information about the future of the market, it is worth mentioning KPMG's conclusions from the 2021 Thailand Insurance Symposium:

1.Life insurers are shifting to health. With an increasing demand from those not currently being serviced, the aim is to make life and health insurance accessible to a broader group of consumers.

2.Insurers increase efficiency by digitising sales tools as part of cost optimisation of the sales force.

3.The operational area is quickly modernised to support service processes and new remote business methods.

4.Insurers go further in automating claims management processes.

Every insurer, not only in Thailand, is surely fully aware that the post-pandemic landscape has caused increased cost pressure and structural changes in operating costs.

With this, it is crucial to examine the challenges before looking at the solutions. An expert in the Asian insurance industry, Angela Hunter, CEO, Board Member, and Advisor to Insurance & Healthcare Industry (Asia Pacific and SEA), analysed this topic during her “Life Insurance SEA Opportunities & Challenges” CUG event presentation in Krakow, Poland, 5 June 2024.

Angela was ex-CEO/Director of Chubb Life Thailand and Myanmar for the last 5 years until February 2024.

What challenges do they have to face—an expert’s point of view

Challenge no. 1: Low penetration

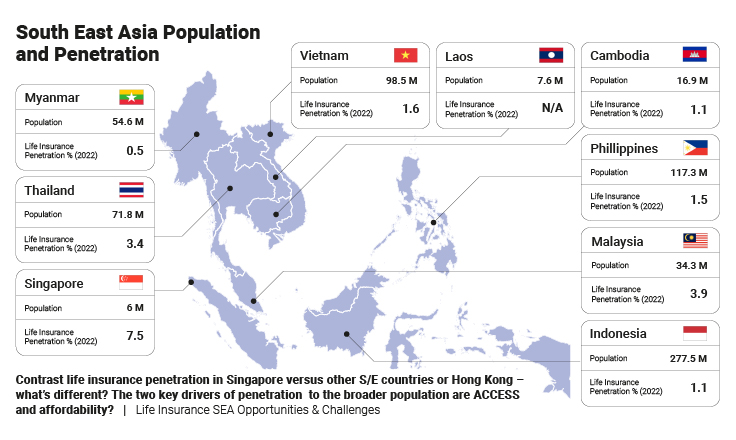

Life insurance penetration in Southeast Asia is still very low despite increasing average incomes, increased awareness of the need for insurance (after COVID-19), and significant advancements in digital technology that can help address some of the challenges. In many countries, such as Indonesia, Vietnam, Cambodia, and Myanmar, it is less than 2%.

It has been well understood for some time that there are challenges in addressing the protection gap due to financial literacy. Some of the cultural aspects of talking about adverse life events and the nature of employment, in addition to the product complexity and limited channels of distribution, resulted in the low affordability of life insurance in Southeast Asia. Addressing financial literacy requires broad communication in social media and other mediums where the target market is consuming information. For example, recent studies on the role of influencers (TikTok) have shown how they are becoming a powerful tool for communication and influencing purchase behaviour, particularly in Southeast Asia. This requires investment and partnerships between insurers and social networks. Currently, the costs of distribution models inhibit these investments.

Challenge no. 2: Insufficient distribution potential

Insurance products are still primarily underwritten and require advice from insurance agents. However, the number of insurance agents in Asia is declining, and there is simply not enough to service the growing demand. Bank partnerships have primarily focussed on selling savings plans, leaving a gap for protection products. This means the product and the distribution channels underserve some parts of the community, which is one of the main reasons for stagnant insurance penetration. Digital and other distribution methods and simpler, more tailored, cheaper products are needed in this market.

Challenge no. 3: Maintaining Profitability

In addition to the above challenges, rising healthcare costs due to advancements in technology and increased usage and pricing in the aftermath of COVID-19, an ageing population, and rising demand for healthcare services are creating challenges for insurers to offer current products profitably and invest in new products, distribution, and technology.

How technology can accelerate market expansion

According to Digital Masterplan 2025 by The Association of Southeast Asian Nations, the ASEAN region has made giant strides toward becoming both a digital economy and a digital society.

1.A substantial portion of the ASEAN population owns broadband devices (either fixed or mobile).

2.Cloud services can make it possible to deliver innovative functionality at a low cost.

3.The pandemic has opened the eyes of policymakers, regulators, and businesses to the advantages of digitally enabling a wide range of economic activities.

What will digitised insurers look like in such a reality and how can they face the challenges? Angela Hunter considers the top five most critical aspects of dealing with these problems:

1.Digital Distribution: Simplified processing and access to new segments, remote and rural areas supported by call centres, click-to-chat, AI, and chatbots.

2.Microinsurance products: Reduced transaction costs and efficient handling of small premiums and claims. A technology to streamline the product development life cycles.

3.Use of Big Data and Analytics: A better understanding of customer needs and behaviour, more accurate risk, and affordable pricing.

4.Artificial Intelligence: Personalisation, prediction of behaviour, better pricing, and fraud detection mechanisms.

5.Telematics and IoT: Wearables, the use of real-time data, dynamic pricing, and encouraging better lifestyle choices packaged with simple insurance coverage.

Comarch supports the view of digitised systems enabling insurers to revamp the product innovation process, resulting in faster time to market for changes and new products. Likewise, digitally enabled integration capabilities can facilitate a more satisfying user experience and increased support for distributor sales processes, and this is a key driver of sales. Modern IT systems can significantly reduce the cost of IT core systems by, for instance, running on commodity hardware versus the mainframe systems used today by many insurers. All told, improved and faster processes enhance customer experience and improve retention.

Learn more about insurance software here.

Authors:

Angela Hunter, Senior Advisor, Insurance Simon Kucher (Freelance)

Angela was previously CEO/Director of Chubb Life Thailand and Myanmar for the last 5 years until February 2024 and previously worked with Prudential, Citibank, and General Electric in executive roles over the last 20 years. She joined Simon Kucher as Senior Advisor and Consultant in August 2024.

Aleksandra Patrycja Romot, Senior Business Consultant; Comarch

Advertise

Advertise