Steven Tan’s journey from graphic designer to maritime publisher

Marine & Industrial Report enters a new chapter after its sale to Charlton Media Group.

Businessman Steven Tan started a magazine that tracked Singapore’s marine and offshore industries in 1977, a decade when many ship owners and shipbuilders all over the world went bankrupt as demand for giant tankers evaporated amidst a global oil crisis.

The collapse in demand was so sudden and so severe that many new ships under construction went straight from the shipbuilder into long-term lay-up in the fjords of Norway or the harbours of Greece and Southeast Asia, author Tim Colton said in his book “A Brief History of Shipbuilding in Recent Times.” A few went to the “breakers” without ever carrying a cargo.

It was during that time when Singapore built large ship repair yards to cater to the fleet requirements of big global tankers, which dominated new ship construction contracts given their relatively simple design.

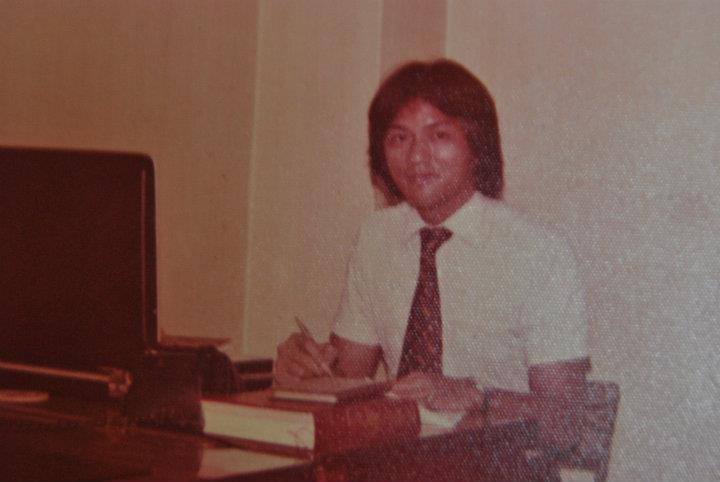

Tan, who was 28 at that time, saw an opportunity that no one else did. Armed with his years of experience as a graphic designer, he started Marine & Industrial Report, covering developments in the shipbuilding and repair industry, marine and offshore equipment supplies, and the latest tech.

“I just followed the trend,” Tan, now 75, told Singapore Business Review. “There was more news on marine and offshore, and I saw the prospects at that time. When I started this business, I had zero capital.”

The magazine, which has been running for almost half a decade, counts as its readers shipowners, shipbuilders, ship managers, ship classification societies, marine consultants, and oil and gas experts across major markets worldwide.

Before his publishing business, Tan sold newspapers when he was young to help his poor family. He attended Saint Joseph's Institution, Singapore’s first Catholic school, and Baharuddin Vocational Institute where he studied advertising arts and display.

He attended classes in the morning, then worked at his sister’s studio in the afternoon. There, he helped provide various art services such as commercial art painting, brush work, lettering in English and Chinese, and drawing large posters on signboards.

The experience shaped him, helping him land his first job as a commercial artist in 1972.

“My experiences from the art studio helped me clinch the job at a company that owned three large shops — a travel centre, wine centre and shopping centre that catered to Japanese tourists,” Tan said.

“I single-handedly took charge of the advertising designs and window displays of the three stores. I also helped out at the airport, where my boss had a wine shop,” he added.

After a year in that company, he worked as an advertising canvasser, soliciting ads for a local publisher. He and his two co-workers left after their employer failed to pay them their wages, and set up the Marine & Industrial Report.

Tan said Singapore, a small nation with seemingly limited shipbuilding potential, steadily evolved into a global industry leader. The transformation began in the Kallang Basin, where ship repair activities were concentrated.

As Singapore’s economy expanded after its independence from Britain in 1965, the government focused on expanding its shipbuilding sector, Tan said. Recognising the need for larger facilities, the city-state encouraged companies to relocate to Jurong, where ample space was allocated for both shipbuilding and ship repair operations.

Jurong in west Singapore houses companies from various industries, such as shipbuilding, repair, and breaking yards, a steel-pipe factory, and an oil refinery. Marine enterprises use the five deep water berths at Jurong port.

Some of the major companies in Jurong are Sembcorp Marine, Keppel Offshore & Marine, YTC Shipyard Pte Ltd., HSD Marine and Shiprepair Pte Ltd, and Singapore Marine Logistics Pte Ltd.

In the early stages of Marine & Industrial Report, Tan faced financial challenges especially after his partners withdrew from the venture before the first issue could be published in February 1977.

But this did not stop him.

“I had to cut alphabet by alphabet to paste the letters and words and line them up manually using sets and T-squares,” Tan said, describing the process of manual typesetting when personal computers were unheard of. “During those days, it was really called ‘cut and paste.’”

When it was time to print his second issue, Tan said he looked for advertisements to raise $100.

“I told myself, ‘I need to have advertisements to survive,” he said. “I tried to solicit for more advertisements and I managed to get a few, which covered my printing costs.”

By the early 1980’s, he had bought a second-hand Intel 286 personal computer, which made typing stories in a word processor much easier.

“I had my DOS (Disk Operating System) on a floppy disk. It helped me a lot because I could do my typesetting using limited fonts, though I still needed to buy Letrasets for headlines,” he said, referring to sheets of typefaces and other artwork that used the dry-transfer lettering method.

Tan said he later upgraded his PC to a faster Intel 386 and then an Intel 486 processor. He knew nothing about computers and had to read books from the public library on how to operate one.

“I didn’t stop upgrading myself by learning WordPerfect, CorelDRAW, Acrobat, Adobe PageMaker, and other software that could help me in my work,” he added.

The businessman noted that the Marine & Industrial Report gave him steady income, whilst letting him meet people in Singapore and around the world.

Whilst producing Marine & Industrial Report, Tan worked as a property agent, helping him send his three children to school. His daughter, who is the youngest child, is now an artist in the US.

Tan prints at least 3,000 copies of Marine & Industrial Report, which is distributed across major markets including Singapore, Hong Kong, China, and South Korea. He has also reached the Middle East, Europe, and the US.

Each Marine & Industrial Report issue is mailed directly to its readers for free. The company makes money through ads.

“From the first publication, all in black and white, to the latest one all in colour… we will help the advertisers really reach out to the buyers,” he said.

Since its inception in1977, Tan said the publication has undergone significant changes in content, style, and readership.

“Our early issues featured a more formal and traditional layout. As design trends evolved, we adapted to more modern prints and layout. We introduced color photography, illustrations, and graphics to enhance the visual appeal of our publication,” he said.

Tan said the publication has also incorporated digital elements, such as QR codes and online exclusives, to cater to its increasingly digital-savvy readership.

The Marine & Industrial Report’s readership now spans across the globe, with a strong online presence. Tan said he has seen a significant increase in younger readers, who are drawn to our publication.

“Overall, our publication has evolved significantly since 1977, reflecting changes in society, culture, and technology. We're proud to have maintained our commitment to quality content and adapting to the needs and interests of our readers,” Tan said.

New chapter

Each issue features partner advertisers from different industries and countries, including power solution provider Cummins, digital business card platform CardMe, international maritime exhibition organizer Marintec China, and industrial group Teledyne Technologies.

One of Tan’s recent Marine & Industrial Report issues featured the collaboration between Azimut Yachts and Volvo Penta to advance hybridisation and electrification in the marine industry.

In 2012, Tan launched the digital and interactive version of Marine & Industrial Report, which helped him reach more readers. He continues to produce both versions since many still prefer hard copies.

Tan, who still works on the trade magazine with his wife Jackie Tee, said Singapore is their biggest market, though it also performs well in Germany, Norway, the US, and Middle East.

Marine & Industrial Report is entering a new chapter after it was acquired by the Charlton Media Group.

“I’m very glad that somebody could bring my publication to a higher level. After all, I'm already 75,” Tan said about the acquisition.

Tan said the acquisition would expand Marine & Industrial Report’s readership reach. The Charlton Media Group, which publishes two-dozen print and online magazines covering industries such as finance, retail, property, energy, healthcare, and insurance for the Asian region, plans to revamp the magazine’s website and host awards for the marine and offshore sectors.

“I will carry on and help and make this publication go another level higher,” he said, adding that the marine industry holds significant potential despite economic challenges.

The global shipbuilding market is expected to grow 6.5% to $220.52b this year from a year earlier, spurred by economic growth in emerging markets, increased demand for cruise ships, growth in seaborne trade, and supportive government policies, according to the Shipbuilding Global Market Report 2024.

The Asia-Pacific region had the biggest shipbuilding market last year, followed by Western Europe, it added.

Tan said he expects shipbuilding demand to continue as the world’s aging fleets upgrade to meet modern standards. Singapore would remain a key player, whilst the shipbuilding industries of China, South Korea, Vietnam, and Malaysia rapidly expand, he added.

Advertise

Advertise