Indo-Crescent region is home to half of the world’s best-performing banks – McKinsey

The region is becoming a hub for banking excellence.

The region has shown remarkable growth in terms of assets and overall payments, according to McKinsey’s Global Banking Annual Review 2023.

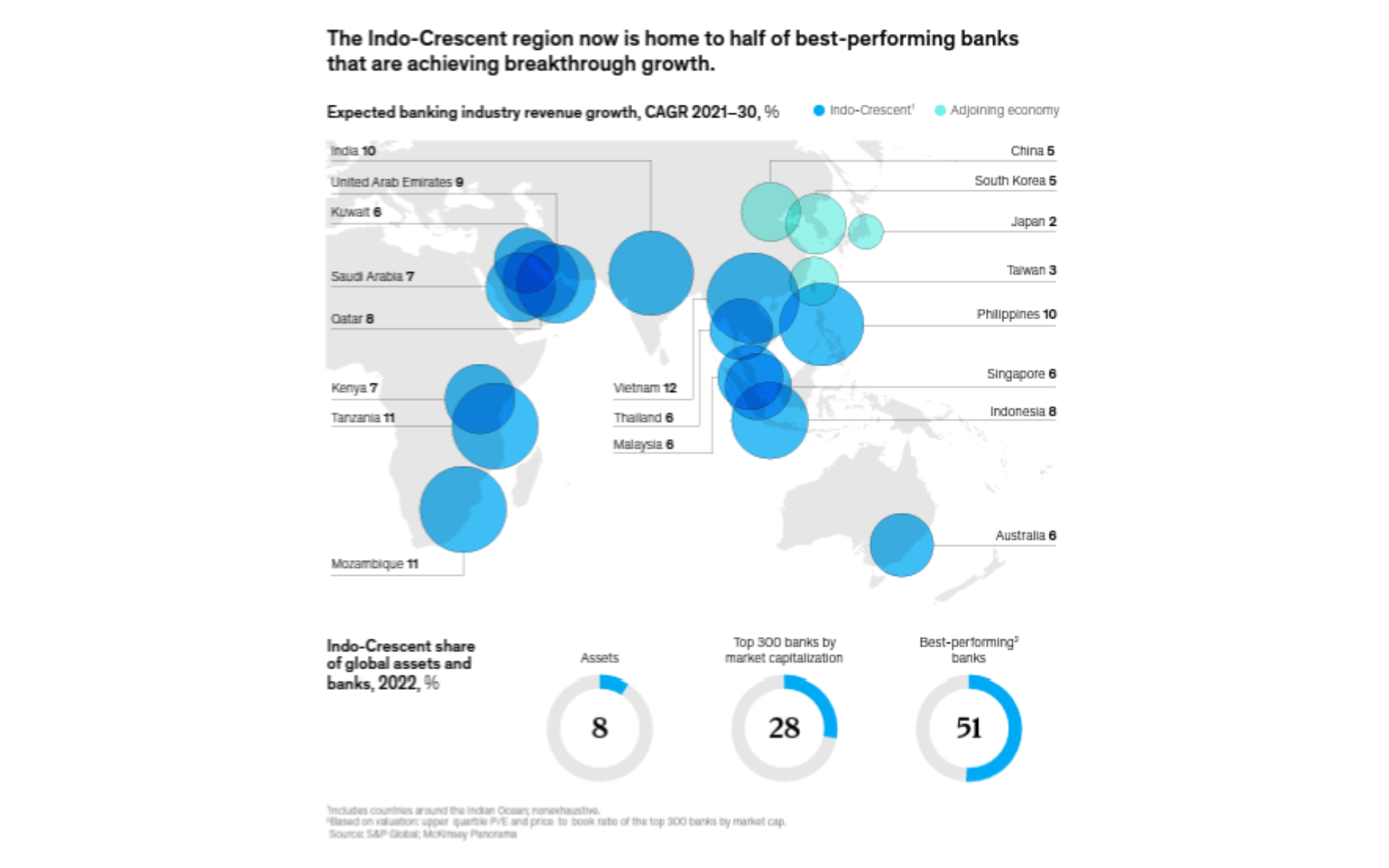

In the ocean region, which we refer to as the "Indo Crescent", a remarkable transformation is underway as the area is becoming a hub for banking excellence, with approximately half of the world's top-performing banks now located here.

The Indo Crescent is poised for accelerated growth in both retail and wholesale banking.

Among the standout innovators in this region is India's HDFC, which is on the path to becoming one of the world's largest banks by market capitalization, following its merger with HDFC mortgage lender.

Notable players in this innovative landscape also include StashAway, a digital wealth management platform serving clients in Singapore and Malaysia, offering fees up to 70% lower than conventional managed portfolio costs.

Additionally, DBS, one of Asia's leading banks, is generating approximately $12.5 billion in annual revenue by delivering end-to-end digital banking services to customers in over ten countries.

Collectively, the Indo-Crescent holds 8% of global banking assets and boasts 51% of the world's top-performing financial institutions.

This outstanding performance can be attributed to various factors, including higher GDP and population growth in select countries within the Indo-Crescent.

It's worth noting that this region encompasses a mix of advanced economies like Australia and Singapore, as well as developing markets such as India, Kenya, and the Middle East.

The success in this region is further fueled by groundbreaking disruptions, ecosystem-driven strategies, and cost-efficient service delivery models.

ALSO READ: Banks urged to integrate ESG data into IT systems: McKinsey

Progress may vary

Combined, 2022 and 2023 have marked a remarkable period for banks in terms of their Return on Equity (ROE), the best in over a decade. However, there's significant variation among different institutions.

Globally, the ROE for financial institutions surged to 12% in 2022 and is expected to reach 13% in 2023, well surpassing the 13-year average ROE of 9.1%.

In 2023, the sector's net income reached $1.4t, doubling the net income from 2017. This increase in ROE was accompanied by higher capital ratios, with the Tier 1 ratio hitting 13.8% globally in 2022-23, the highest in a decade.

Banks also continued to focus on cost efficiency, with the cost-to-income ratio dropping by seven percentage points, partly driven by changes in margins. This trend was also reflected in the cost-per-asset ratio, which declined from 1.6 to 1.5.

On a global scale, the financial services sector facilitated around $400t in assets and generated $6.8t in revenue in 2022, setting new records compared to the $375t in assets and $6.4t in revenue in 2021.

Intermediation has outpaced overall economic growth, growing at an average annual rate of about 6% since 2017, compared to real GDP growth of around 3%.

When examining these figures in detail, variations across the industry become apparent.

Most of the intermediation revenues were concentrated in corporate, commercial, and retail banking, following the usual pattern. The most profitable sectors were wealth and asset management, capital markets infrastructure, and payments.

In corporate and commercial banking, interest rates have improved transaction banking margins, despite a slowdown in corporate deal volumes since 2021.

In wealth and asset management, the top performers have been pulling away from the rest since 2019, although overall costs have risen industry-wide, particularly for asset managers due to negative equity and bond performance in 2022.

In capital markets, revenue pools continue to grow on the buy side, while the sell side has seen stagnant revenues. This shift caused the share of intermediation revenue to decline by one percentage point to $480b.

In retail banking, the adoption of new technologies has enabled some banks to operate with the efficiency of tech companies. Distribution is shifting from omnichannel to fully mobile channels.

Lastly, in the realm of payments, global revenues are rapidly increasing, especially in Asia, driven by the acceleration of contactless and digital payments and the growing demand for embedded finance in deposits, payment issuance, and lending.

Advertise

Advertise