Taiwan's general insurance to grow 6.8% annually to 2028

The industry is forecast to grow by 9% in 2024.

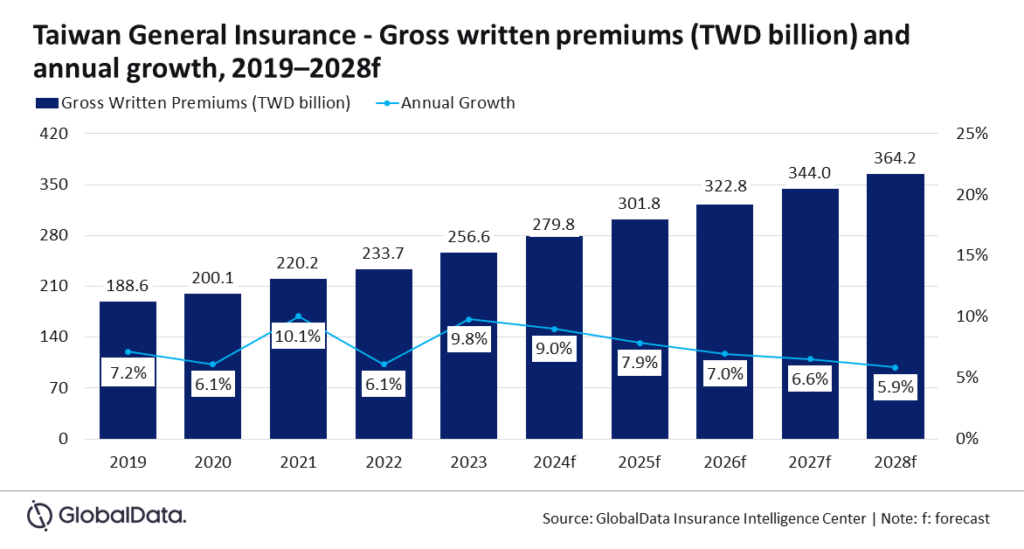

Taiwan’s general insurance industry is projected to garner a compound annual growth rate (CAGR) of 6.8%, with gross written premiums (GWP) increasing from $9.0b in 2024 to $12.2b in 2028, according to GlobalData.

The growth is underpinned by rising motor sales, higher premium rates in motor and property insurance, and demographic shifts such as an ageing population.

The industry is forecast to grow by 9% in 2024.

“Taiwan’s general insurance industry grew by 9.8% in 2023, driven by economic growth that led to an increase in exports and domestic consumption,” Sutirtha Dutta, Insurance Analyst at GlobalData said in a report.

“Increasing vehicle sales and a rise in premium rates for motor and property insurance also supported the growth of general insurance. The trend is expected to continue in 2024,” Dutta added.

Motor insurance, the largest segment, is expected to account for 50.2% of total GWP in 2024, growing 7% year-on-year. Vehicle sales, which grew by 11% in 2023 to reach 476,987 units—the highest since 2005—are a key driver.

However, increasing traffic accidents are raising claim volumes and costs. In 2023, Taiwan recorded 402,926 traffic accidents, up 7.2% year-on-year, leading to a 7.1% rise in gross motor insurance claims. Premium rates for motor insurance are expected to

increase by 6% in 2024 as insurers reassess risk exposure. Over the forecast period, motor insurance is projected to grow at a CAGR of 5.5%.

Property insurance, the second-largest segment, is anticipated to account for 23% of GWP in 2024 and grow by 15.9%, driven by Taiwan's vulnerability to natural disasters such as earthquakes and typhoons.

For instance, the Hualien Shoufeng Earthquake in 2024 caused NT$473m in insured losses. Despite the availability of an earthquake insurance plan, only 38.6% of households are covered, presenting a growth opportunity. Property insurance is expected to grow at a CAGR of 2.8% from 2024 to 2028.

Personal Accident and Health (PA&H) insurance, representing 10% of GWP in 2024, is forecast to grow by 7.4% in 2024, driven by rising medical costs and an ageing population.

The share of people over 65 is set to reach 18.8% in 2024. This segment is also expected to grow at a 7.4% CAGR through 2028.

Liability, marine, aviation, transit (MAT), financial lines, and other general insurance lines are projected to account for the remaining 16.7% of GWP in 2024.

“Taiwan’s goal to achieve an annual economic growth of around 3% in the next four years will support the growth of the general insurance industry,” Dutta said.

“With the government’s push for net-zero emission path by 2050, continued investments in the renewable energy sector and electrification and carbon-free transportation will support the growth of the general insurance industry over the next five years,” concluded Dutta.

Advertise

Advertise