Global insurers post 6.8% premium gain in 2024 on expansion

Eighteen out of the 20 companies reported premium growth.

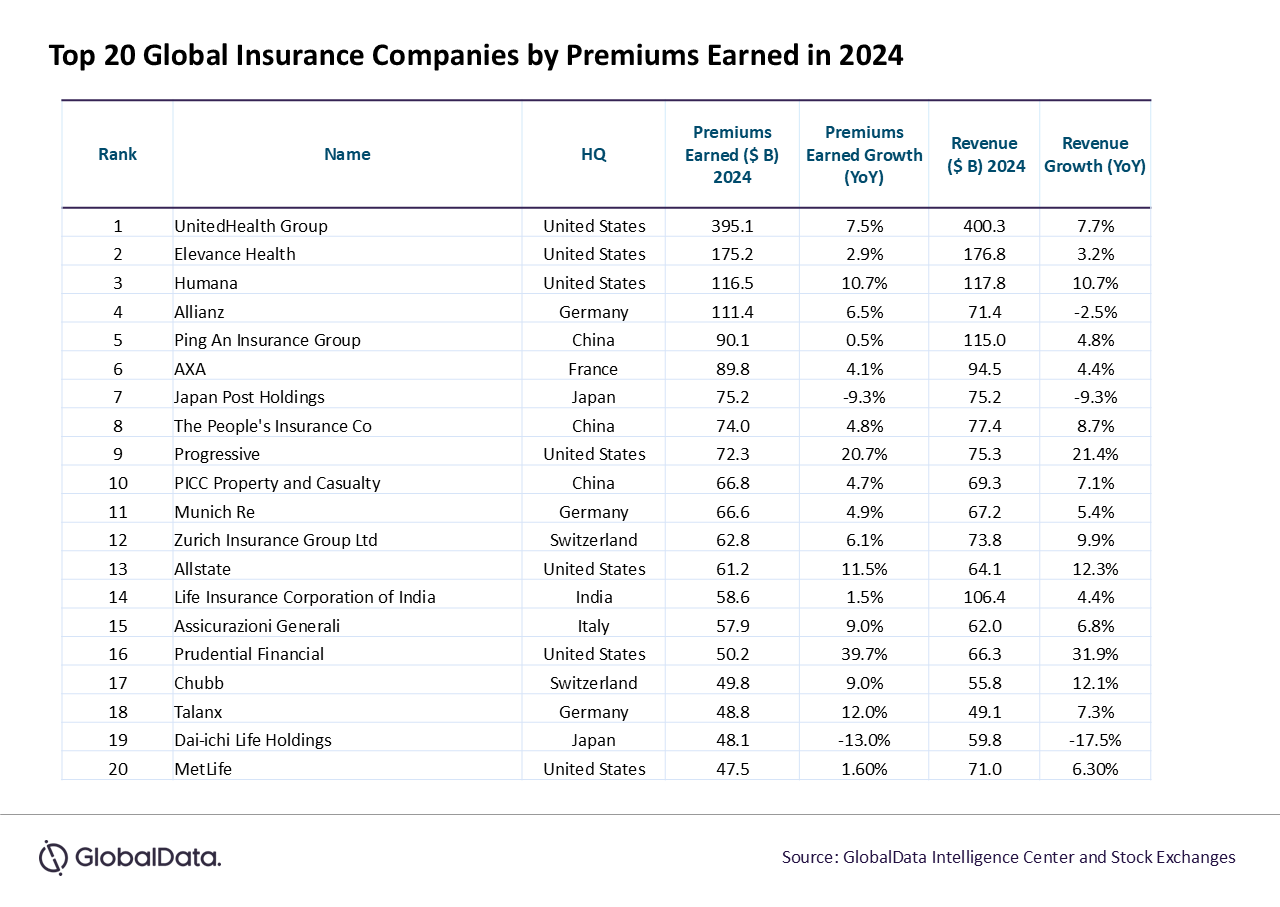

The world’s top 20 publicly listed insurance companies posted a 6.8% year-on-year increase in average premium earned in 2024, supported by higher interest rates, strong equity market returns, and gains from ongoing digital and geographic expansion, according to GlobalData.

Eighteen out of the 20 companies reported premium growth.

Prudential Financial led the group with a 40% rise in premium earnings, driven by growth in its group disability and supplemental health business, along with stronger variable life sales through its advisor network.

Progressive followed with a 20.7% increase, fuelled by a rise in new personal auto applications and premium rate hikes in both personal and commercial auto segments.

On the other end, Japan-based Dai-ichi Life Holdings saw premiums fall 13% due to weaker sales at its Dai-ichi Frontier Life subsidiary.

Japan Post Holdings reported a 9.3% decline, reflecting fewer policies in force and higher short-term costs tied to a rise in new policy issuance.

GlobalData analyst Murthy Grandhi said the premium growth reflects broader shifts in consumer behaviour, particularly in response to rising financial literacy and a demand for insurance products with savings elements.

Rising incomes and middle-class expansion, especially in emerging markets, are also boosting life insurance demand, whilst job market volatility and rising healthcare costs are driving interest in more flexible, customisable insurance options.

Looking ahead, GlobalData expects insurers to face a more complex operating environment in 2025.

Geopolitical tensions, including the war in Ukraine and instability in the Middle East, could disrupt global reinsurance markets and elevate political risk.

At the same time, continued trade tensions and tariff increases may affect investment sentiment and raise supply chain risk exposures, prompting insurers to reassess pricing models.

Inflation remains a key concern, particularly in the motor and property segments, where rate increases are expected to continue.

Insurers are also under increasing pressure to strengthen cybersecurity, following a series of high-profile attacks that exposed systemic weaknesses.

Regulatory tightening across markets may increase compliance costs but could also improve transparency and consumer confidence.

Grandhi added that long-term demand for health, life, and retirement products will be supported by demographic trends, including ageing populations.

Insurers with diversified portfolios, strong digital capabilities, and wide geographic reach are expected to be better positioned to manage risks and tap into growth opportunities in emerging markets.

Advertise

Advertise