Vietnam’s life insurance sector slated for dip this 2025

This follows consecutive contractions of 12% in 2023 and an estimated 5.7% in 2024

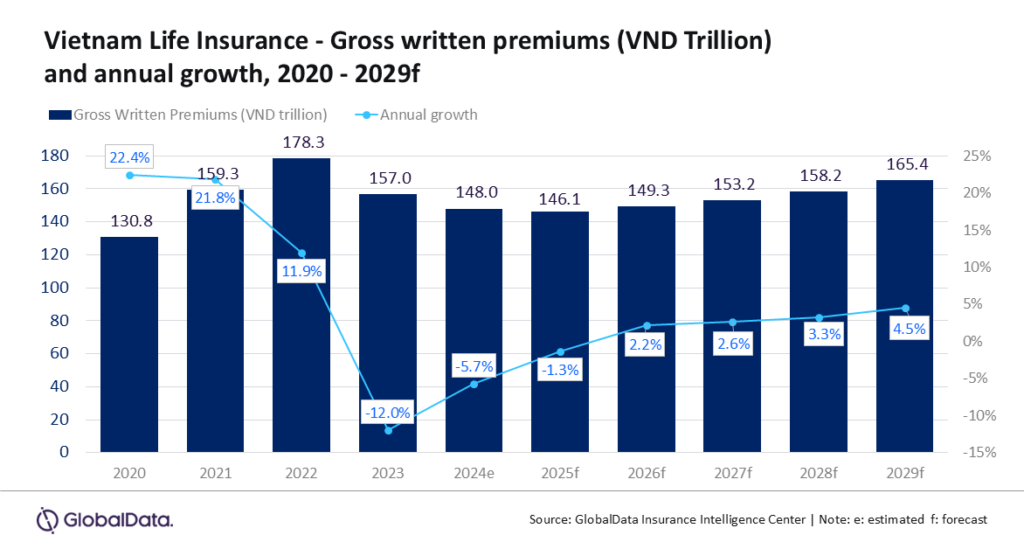

Vietnam’s life insurance market is projected to contract by 1.3% in 2025, reaching $6.0b in gross written premium (GWP), down from $6.1b in 2024, according to data from GlobalData.

The decline follows consecutive contractions of 12% in 2023 and an estimated 5.7% in 2024, driven by irregularities in bancassurance sales and economic challenges.

Despite the downturn, the market is expected to recover in 2026, supported by an aging population, low insurance penetration, rising household income, and regulatory reforms. GlobalData projects a compound annual growth rate (CAGR) of 3.2% from 2025 to 2029, with the market reaching VND165.4 trillion ($6.4 billion) in 2029.

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, attributes the market's recent decline to irregularities in life insurance distribution.

Issues such as false commitments, vague provisions, misselling, and the practice of bundling life insurance with bank loans have eroded consumer confidence.

This has led to a sharp rise in policy cancellations, causing the number of active life insurance policies to drop by 7.5% in 2023 and 3.7% in 2024.

Insurance penetration also fell from 1.9% in 2022 to 1.5% in 2023 and is estimated to reach 1.3% in 2024.

“Amidst the confidence crisis, however, strict regulations to control these irregularities and demographic shifts will support market recovery,” Sahoo said. “Additionally, the low life insurance penetration in Vietnam, which is much lower than APAC peers such as Thailand (3.5%) and Taiwan (Province of China) (8.7%), provides abundant growth opportunities,”

The revised Insurance Business Law, effective November 2023, prohibits the sale of life insurance products before and after 60 days of loan disbursement and imposes fines on banks for tying non-mandatory insurance to loans.

These measures aim to rebuild consumer trust and stabilise the market.

Endowment insurance, which accounted for 86.1% of the GWP in 2024, remains the dominant segment.

Demand for these products is expected to grow, driven by the introduction of savings policies covering critical illness and hospitalisation, particularly benefiting the elderly population.

Additionally, technological advancements, including AI, big data analytics, and digital platforms, are set to enhance customer experience and service quality.

Supplementary insurance, which made up 12.3% of the market in 2024, is expected to grow to 13.7% by 2029, with a projected CAGR of 4.9% from 2025 to 2029.

Insurers are focusing on expanding coverage and improving service quality to attract more customers.

“Post 2025, the outlook for Vietnam’s life insurance market looks optimistic due to stricter regulation to instill consumer confidence, technological advancements, and a focus on customer-centric products,” Sahoo said.

Rising healthcare costs and an aging population will further boost demand, ensuring steady growth in the coming years, added Sahoo.

Advertise

Advertise