Mitsui Sumitomo Insurance targets Chinese nationals in Thailand

The Chinese accounted for 53% of foreign students in Thai universities last year.

Mitsui Sumitomo Insurance Co., Ltd. expects its recent bancassurance tie-up to boost sales to Chinese investors and students in Thailand, where their influx has reshaped the nation’s higher education landscape and sparked interest in the property sector.

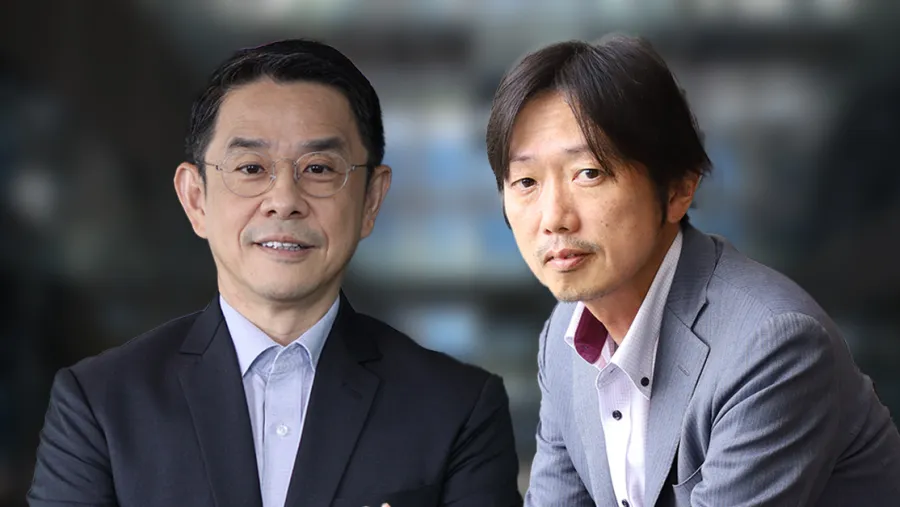

“We see a real opportunity to better serve the growing number of students travelling between Thailand and China,” Rattapol Gitisakchaiyakul, CEO at MSIG Insurance (Thailand) Public Co. Ltd. (MSIG Thailand), told Insurance Asia.

“By using data and insights into their travel habits, preferences, and behaviours, we can tailor insurance plans that will meet their needs—whether it’s coverage for medical expenses, study interruption benefits, or round-the-clock assistance,” he said in an emailed reply to questions.

MSIG, the Japanese insurer’s Thai unit, and Mitsui Sumitomo Insurance Thailand Branch (MSITB) signed a bancassurance deal with Bank of China (Thai) Public Co. Ltd. (BOC Thai) and China Pacific Insurance (CPIC) in May.

Under the deal, MSIG and MSITB will also sell insurance to BOC Thai’s more than 1,000 corporate clients.

Chinese students almost doubled to more than 28,000 last year from 2020, accounting for 53% of foreign students in Thai universities, according to the Ministry of Higher Education, Science, Research and Innovation.

Investment promotion applications surged 40% to 3,137 last year from a year earlier, according to Thailand’s Board of Investment (BoI).

Foreign direct investment (FDI) accounted for 73% of the total 2024 application value, rising 25% year on year. Singapore was the top FDI source, with 305 projects worth $11b (THB357.5b), largely from Chinese and US companies operating there. China followed with 810 projects worth $5.4b (THB174.6b).

“With Chinese investments in Thailand on the rise, this partnership puts us in a strong position to support Bank of China's corporate clients with a comprehensive range of insurance solutions—from construction and logistics to property,” Shingo Adachi, senior vice president at MSITB, told Insurance Asia in an emailed response.

He also sees opportunities in catastrophe insurance, as well as the growing demand for retirement coverage.

“The risk landscape is becoming increasingly complex and dynamic,” Adachi said. “Take earthquakes for instance—they used to be seen as a low risk in Thailand, but with weather patterns becoming more extreme and unpredictable, we can’t make those assumptions anymore.”

Meanwhile, young consumers want digital-first and easy-to-understand products. “That means we can’t just keep doing what we’ve always done; we have to evolve,” he added.

Rattapol said technology is moving fast, “and it’s going to continue transforming how we serve customers, especially through data and digital tools that allow for more personalised and efficient service.”

Advertise

Advertise