Vietnam general insurance market to grow 7% annually through 2029

The sector is expected to grow 5.9% year-on-year this 2025.

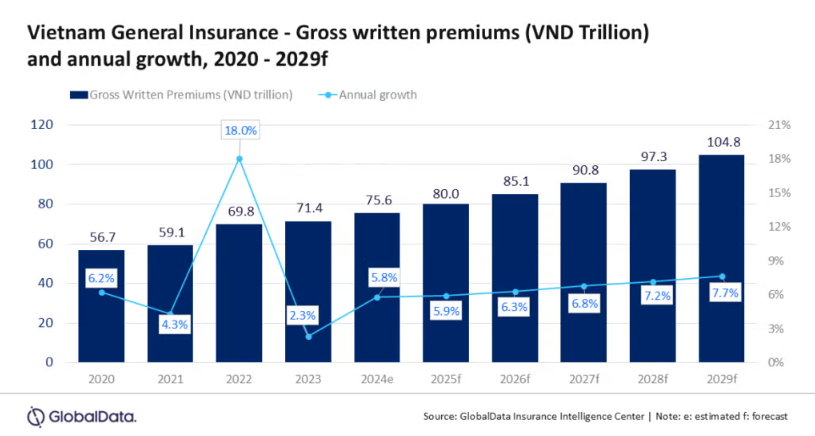

Vietnam’s general insurance market will likely pencil a compound annual growth rate (CAGR) of 7% from $3.2b this year to $3.9b in 2029, according to GlobalData.

Furthermore, the sector is expected to grow 5.9% year-on-year this 2025, in terms of gross written premium.

“The general insurance industry in Vietnam is poised for growth, supported by a burgeoning economy and rising demands for property and casualty insurance products,” Swarup Kumar Sahoo, senior Insurance analyst at GlobalData, said in a report.

Growth is being driven by rising natural disaster risks, broader health insurance coverage, increased demand for microinsurance, and supportive regulatory reforms.

Vietnam’s economy is expected to expand by 6.5% in 2025 and 6.4% in 2026, underpinned by technology exports, foreign investment, and public infrastructure projects.

However, the potential impact of a US reciprocal baseline tariff of 10%, plus an additional 46% tariff—currently suspended for three months—could pose a threat to growth.

Personal Accident and Health (PA&H) insurance is projected to be the largest business line, accounting for 32.0% of general insurance GWP in 2025.

High medical inflation and increased awareness of health coverage are supporting the segment’s expansion.

The amended health insurance law, which takes effect on 1 July, will allow for greater use of technology in streamlining treatment and claims, helping reduce fraud and improve insurer profitability.

PA&H insurance is expected to grow at a 5.3% CAGR between 2025 and 2029.

Property insurance is forecast to make up 30.9% of general insurance GWP in 2025, with a CAGR of 11.2% through 2029.

Increased demand for natural catastrophe (NatCat) coverage is driving this growth.

The Ministry of Public Security reported 3,922 fire incidents between September 2023 and September 2024, resulting in $1.2b in damages.

Severe weather events like Super Typhoon Yagi and Storm Trami in 2024 are also expected to sustain demand for property insurance, which is projected to rise 10.5% in 2025.

Motor insurance is estimated to account for 23.5% of the general insurance GWP in 2025.

The segment declined by 2.2% in 2023 due to weak vehicle sales but is recovering.

In November 2024, vehicle sales rose 58% year-on-year to 44,200 units, according to the Vietnam Automobile Manufacturers’ Association.

Regulatory requirements for compulsory motor liability insurance and the growing adoption of electric vehicles (EVs) are expected to support growth.

Some insurers have introduced comprehensive EV coverage, including battery insurance.

The remaining 13.6% of GWP in 2025 will come from other general insurance lines.

“Regulatory reforms and a growing demand for health and natural hazards insurance will drive Vietnam’s general insurance market growth,” Swarup said. “Furthermore, the growing popularity of microinsurance and specialised products for electric vehicles will enhance market penetration in the coming years.

But, the proposed US reciprocal tariff could change the dynamics and is a rising threat to insurers’ profitability, warned Swarup.

Advertise

Advertise