CareEdge

CareEdge is a knowledge-based analytical group offering services in Credit Ratings, Analytics, Consulting and Sustainability. Established in 1993, the parent company is CARE Ratings Ltd (CareEdge Ratings).

The wholly-owned subsidiaries of CareEdge Ratings are (I) CARE Analytics & Advisory Private Ltd previously known as CARE Risk Solutions Pvt Ltd, and (II) CARE ESG Ratings Ltd, previously known as CARE Advisory

Research and Training Ltd. CareEdge Ratings’ other international subsidiary entities include CARE Ratings Africa (Private) Limited in Mauritius, CARE Ratings South Africa (Pvt) Ltd, and CARE Ratings

Nepal Limited.

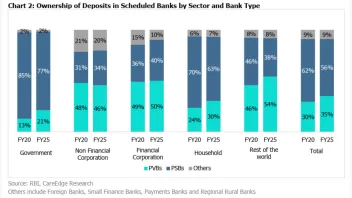

Indian public bank deposit share slumps to 56% as private rivals surge

Indian public bank deposit share slumps to 56% as private rivals surge

Household savings held by private lenders climbed from 30% in 2020 to 35% by 2025.

India insurance premiums hit $131b as agents lose dominance

Bancassurance and alternative channels now drive the bulk of incremental growth in non-life sectors.

India non-life could rise up to 11% as regulator rewrites access

Insurance for All by 2047 backs faster product clearance and wider agent tie-ups.

Will 100% FDI trigger India insurance consolidation?

It could also increase competition and expand reinsurance capacity in the domestic market.

India’s non-life insurance premiums rise 2.4% in July 2024

The Bima Trinity initiative is expected to drive further sector growth.

India life insurers post steady May growth despite policy volume drop

Annual Premium Equivalent by 14.4%.

India's life insurers report 8.4% rise in premiums for April 2025

Growth in individual non-single premium policies declined by 13.6% YoY.

India’s life insurers post 5.1% growth in FY 2025 premiums

CareEdge said premium growth is expected to remain volatile.

India's life insurance growth slows to 10.6% in October

The industry is expected to grow by 1% to 13% over the next three to five years.

India's life insurance APE growth slows to 10.5% in August

LIC's performance in 5M FY 2025 outpaced its private sector peers

India’s life insurance industry sees 20.2% YoY APE growth in June

CareEdge foresees medium-term outlook to remain positive.

India’s non-life sector bags double-digit growth

It saw its premiums surge 14.9% in May.

Advertise

Advertise

Commentary

Ingredients take centre stage for Asian consumers across food and beverage purchases

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision